Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy.

Benjamin Hamidi

Senior portfolio manager, ABN AMRO Investment Solutions.

Based in: Paris, France

“The US economy remains robust, but global growth in industrial activity is still sluggish. At this stage, the Fed is keeping its key rates unchanged and confirming its bias in favour of future rate cuts, even though it acknowledges that these cuts are likely to start later than initially anticipated due to slower disinflation since the start of the year. In Europe, the economic data have come as a positive surprise, with slightly positive growth and disinflation continuing, pointing to the ECB’s first rate cut as early as June. In this context, we are maintaining a balanced approach, with an overweight in US equities strategies.”

Luca Dal Mas

Senior fund analyst, Aviva Investors.

Based in: London, UK

“US CPI data earlier in the month surprised on the upside, which led to rises in yields, with US Treasuries hitting the highest level since mid-November. This latest data comes after a few months when the disinflation story had been losing steam, triggering a repricing of central bank expectations towards fewer cuts than previously expected. Higher yields and geopolitics weighed on risk assets, with equity markets falling while large cap continued to outperform small caps. Towards the end of the month strong earnings data, particularly among tech companies, saw the market rebound from the correction of the previous couple of weeks. Following inflationary surprise and geopolitical instability, we have marginally reduced our exposure to developed equities and European sovereign bonds..”

Jorge Velasco

Director of Investment Strategy, CaixaBank Private Banking.

Based in: Madrid, Spain

“This month we unwind the position we opened a few months ago in emerging market debt in local currencies and strengthen our positions in European equities, both through the index fund and the value-biased position. In this way, we modify the balance between fixed income and equities, showing a greater willingness to take on a little more risk in the portfolio, although we continue to move within parameters close to neutrality by asset class.”

Adam Norris

Investment Manager in the Multi-manager team, Colombia Threadneedle Investments.

Based in: London, UK

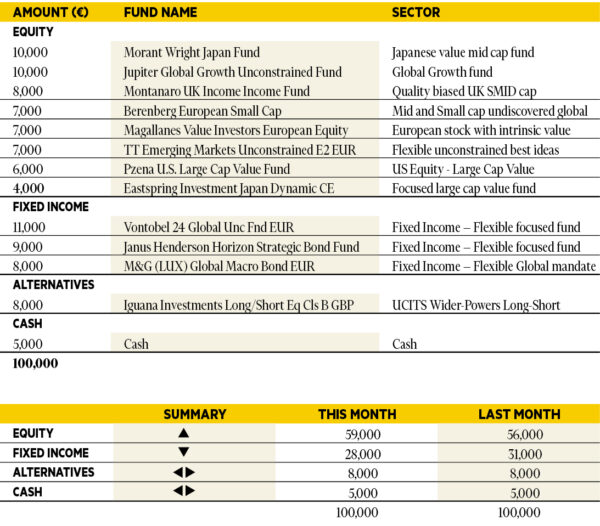

“Strong economic data, particular in the US, continues to prove to be robust in the face of higher interest rates. Despite spending much of their Covid-induced savings, US consumers remain buoyant as they are now enjoying above-inflation wage growth. As a result, the market pared back the expected number of rate cuts in the US economy. With resumed upwards pressure on bond yields and credit spreads at multi-year lows, we have reduced our exposure to fixed income, once again, holding cash as an alternative. Equity earnings appear healthy, but the multiple investors will be willing to pay may be vulnerable. We own more cash as a result. In April, the best performer was TT Emerging Markets Unconstrained Fund, as emerging markets regained some ground after a tough 12 months. The worst performer was Janus Henderson Horizon Strategic Bond Fund, which retains exposure to long duration fixed income and high-quality but lowly yielding credit.”

Silvia Tenconi

Multimanager Investments & Unit Linked, Eurizon Capital SGR.

Based in: Milan, Italy

“In April, the performance of the portfolio was slightly negative, with Allianz Europe Equity Growth and Robeco US Select Opportunities detracting the most. Interest rates in the US and Europe rose again, putting pressure on risky assets in developed markets. On a positive note, China posted a very positive performance, after a difficult start to the year. Given the rise in yields, we’re adding again to our position in Eurizon Fund – Bond Italy Medium Term LTE, reducing Epsilon Fund – Euro Cash. In equities, we keep our cautious stance for now.”

Richard Troue

Fund Manager, Hargreaves Lansdown Fund Managers.

Based in: Bristol, UK

“I’ve been constructive on the UK for a while, warning against writing the market off. As recently as January I wrote here about the scale of share buybacks – nobody else wanted to buy UK shares, so companies were buying back their own. With valuations at rock bottom, we’ve also seen plenty of takeover activity. There are still headwinds to overcome, including underinvestment in UK shares by pension funds and a lack of ‘exciting’ tech companies. But, for the patient investor, there are bargains to be had and attractive dividends to collect while you wait. This portfolio maintains broad exposure to the UK stockmarket via experienced teams at Artemis, JOHCM, and Liontrust.”

Paul Hookway,

Senior Fund Analyst, Kleinwort Hambros.

Based in: London, UK

“Rather surprisingly UK equities outperformed global markets, with US stocks languishing at the back of the following pack. While this impacted our returns we see no reason to increase UK exposure at this stage; indeed so far in May the losses have been reversed. Inflation in the US remains ‘sticky’ but continues to fall in the UK and Europe where we expect rates to be cut first resulting in continued US dollar strength. Currently none of our US dollar exposure is hedged, but we will add should it reach extreme valuation levels. We made one change to the portfolio, switching Lyxor Sandler US Equity into Lyxor Epsilon Global Trends, a trend following strategy which offers superior diversification qualities.”

Antti Saari

Chief Investment Strategist, Nordea investments.

Based in: Copenhagen, Denmark

“After reaching all-time highs the stockmarket declined slightly in April, with geopolitics and inflation weighing on sentiment. In our view, elevated sentiment that had prevailed for some time was as much to blame for the small correction as were geopolitics and inflation. Economic growth has proven to be surprisingly resilient, and despite strong economic activity earnings growth was expected to slow in Q1. Reports have, however, been much better than this, and the growth rate in the US is around the same as for Q4. Downside risks still remain but overall the outlook is broadly balanced. We expect the uptrend to continue and maintain an overweight in equities.”

Didier Chan-Voc-Chun

Head of Multi-Management and Fund Research at Union Bancaire Privée (UBP).

Based in: Geneva, Switzerland

“Firmer US Personal Consumption Expenditure (PCE) data than expected did not create any notable reaction in any of the major asset classes. The market was probably already expecting a high reading after the strong Core PCE Price Index growth released with GDP data. Despite the uncertainties, we expect that higher all-in yields will continue to attract fixed income investors, even as the rate-cutting timetable is pushed back, likely for some months. Investor sentiment towards EM assets worsened last week with continuous outflows from both local-currency and hard-currency debt funds. While maintaining our preference for the quality factor we have decided to keep our portfolio unchanged.”