Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy.

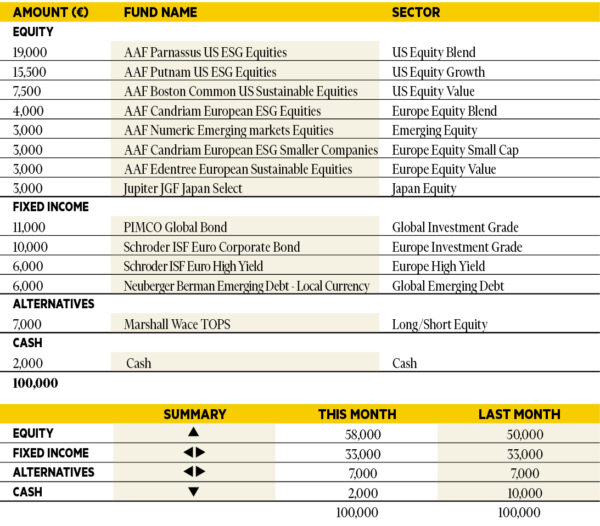

Benjamin Hamidi

Senior portfolio manager, ABN AMRO Investment Solutions.

Based in: Paris, France

“Market conditions remain resilient, despite a strong US labour market, inflation figures, Fed forecasts and the market’s adjustment of the expected number of rate cuts over the next few months. Good economic surprises in the US, the stabilisation of unfavourable credit conditions and a fairly good earnings season against a backdrop of resilient profit margins are supporting the market. Accelerating productivity, particularly in sectors linked to US technology, could continue to support profit margins. In this context, we have strengthened our equity positioning, maintaining our preference for US equities and favouring US growth stocks over European equity strategies.”

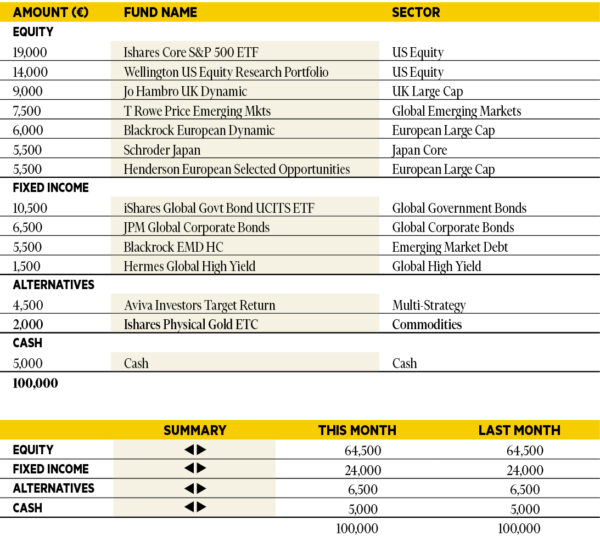

Luca Dal Mas

Senior fund analyst, Aviva Investors.

Based in: London, UK

“On the economic front, the latest data for February showed little change in manufacturing or services. Overall, the survey suggests global manufacturing remains soft, albeit better than a few months ago. During the month, most of the focus was on corporate earnings, with the better-than-expected Nvidia results pushing the stock and equity indices higher. More broadly, the earnings season in both the US and Europe has been solid, with beats on both revenues and sales. On the interest rates side, the market is now pricing between two to three cuts for this year, which fits with central banks’ tone. Markets responded favourably to economic and corporate data, with equity indices moving higher and Japan outperforming most developed markets.”

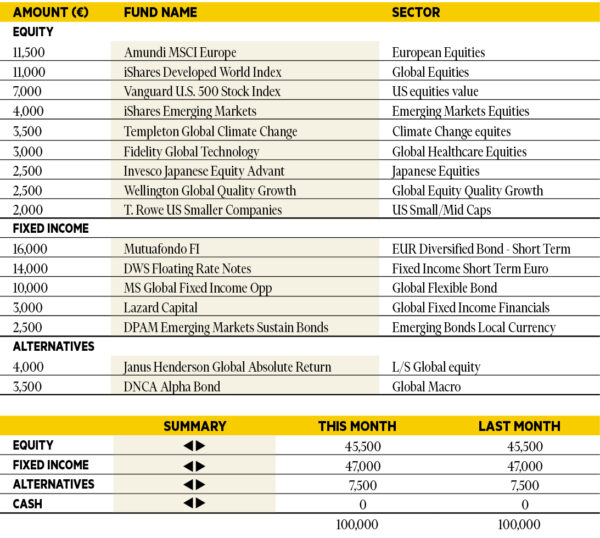

Jorge Velasco

Director of Investment Strategy, CaixaBank Private Banking.

Based in: Madrid, Spain

“The various inflation data published in recent weeks have led to a significant adjustment in expectations of rate cuts by central banks. For the Federal Reserve, the market is now discounting 87 bps of rate cuts in 2024 when a month and a half ago it was discounting 168 bps and now sees June as the most likely meeting for a cut (they assign a probability of 80 per cent) when in mid-January the most likely meeting for a cut was March. Something similar has happened in the eurozone. The market is now discounting 91 bp of ECB rate cuts in 2024 when a month ago it was discounting 161 bps, with June also being the most likely meeting for a cut. In this environment, we are keeping our portfolio unchanged and maintaining the rate sensitivity of the fixed income portfolio at low levels.”

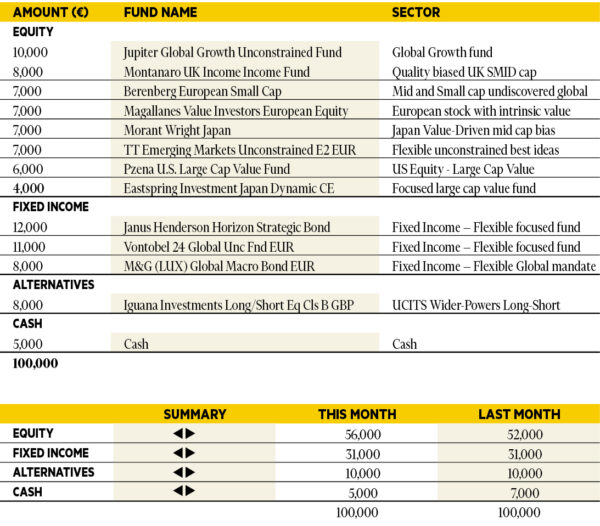

Adam Norris

Investment Manager in the Multi-manager team, Colombia Threadneedle Investments.

Based in: London, UK

“The strong equity markets of January continued through February, this time with a broadening out into multiple regions; US, Japanese and emerging markets all performed well. Central banks tried their utmost to pushback on pre-emptive interest rate cuts, despite inflation pressures continuing to cool. As a result, fixed income returns were meek, particularly from funds invested more in core government bonds, as opposed to credit. However, given the strong earnings momentum, we have added to equities in the month at expense of cash and absolute return. The best performing fund was Jupiter Global Growth Unconstrained, a fund full of businesses which use technology to create further future revenue streams for themselves, clearly benefitted from the AI-driven rally. The worst performer was Janus Henderson Horizon Strategic Bond which is running close to its highest interest duration since strategy inception. As a result of the GVQ Focus fund moving to a different investment manager, Montanaro UK Income was added to the portfolio holdings, a fund which should benefit in a recovering small cap market.”

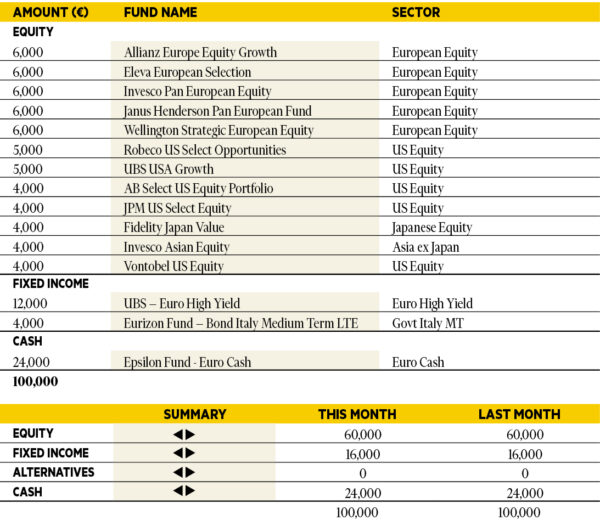

Silvia Tenconi

Multimanager Investments & Unit Linked, Eurizon Capital SGR.

Based in: Milan, Italy

“In February the performance of the portfolio was very positive, with UBS USA Growth and Allianz Europe Equity Growth contributing the most. It was another good month for equities and high yield assets, while government and high-grade corporate bonds were hurt by rising interest rates, both in the US and in the eurozone. Markets are now incorporating fewer rate cuts and stronger economic growth, showing some complacency in our view. Albeit recession is not our scenario, we think bouts of volatility may still appear, and keep some dry powder in the portfolio.”

Richard Troue

Fund Manager, Hargreaves Lansdown Fund Managers.

Based in: Bristol, UK

“Japan hit the headlines in February when the Nikki 225 finally surpassed its December 1989 peak. Typically, it’s best not to obsess over milestones like this, but it does inevitably make you wonder how much further there is to go. I think there’s still room for growth. Reforms enacted in recent years are paying off and company fundamentals look strong, with decent earnings growth expected this year. It’s a market I’m still happy to have exposure to through GLG Japan CoreAlpha, which has a tried and tested approach of investing in undervalued, out of favour companies, and waiting patiently for them to turnaround.”

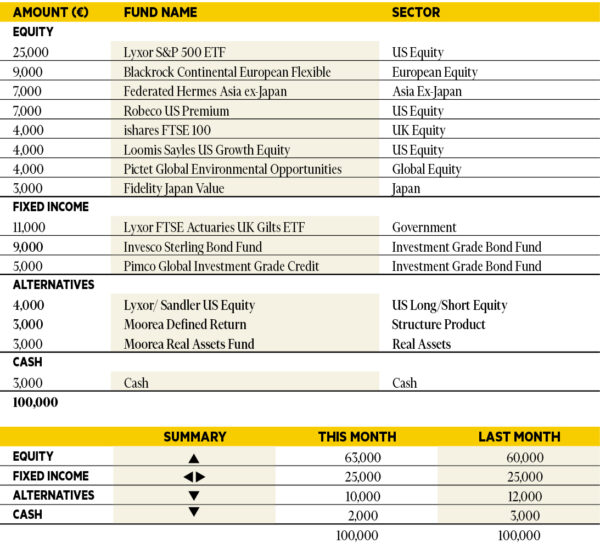

Paul Hookway,

Senior Fund Analyst, Kleinwort Hambros.

Based in: London, UK

“Inflation remains ‘sticky’ with future rate cuts being pushed back until later in the year. The US economy remains robust with no compelling reason for rate cuts in the short term, which are a requirement for UK and Europe to cut rates. We have seen an upward tick in key economic indicators in the US and form a turning point in Europe. This has made us more positive on the outlook for equities, in particular in Europe, where valuations remain attractive. We decided to reduce our alternatives allocation to increase our European equity allocation, adding to BlackRock Continental European Flexible. We also increased our Japanese exposure, financed form cash.”

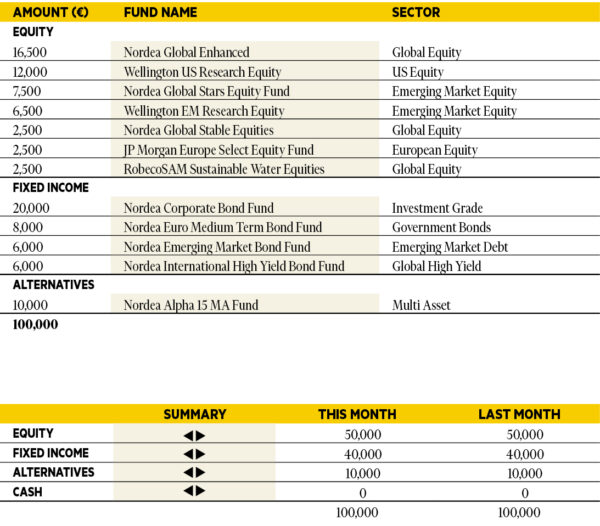

Antti Saari

Chief Investment Strategist, Nordea investments.

Based in: Copenhagen, Denmark

“Equities marched higher in February on the back of better-than-expected economic data and earnings. Meanwhile, strong macro figures and higher than expected inflation lifted bond yields and led to a more realistic market pricing of policy rates. We expect economic and earnings growth to broaden out and thus continue to support risky assets going forward. Valuation is chiefly a concern for the US and only if earnings disappoint, but this is not our base case. Outside the US, valuation is at its long-term average whereas in the US, improved corporate profitability justifies part of the increase in multiples. Put together, we continue to overweight equities in our recommendations.”

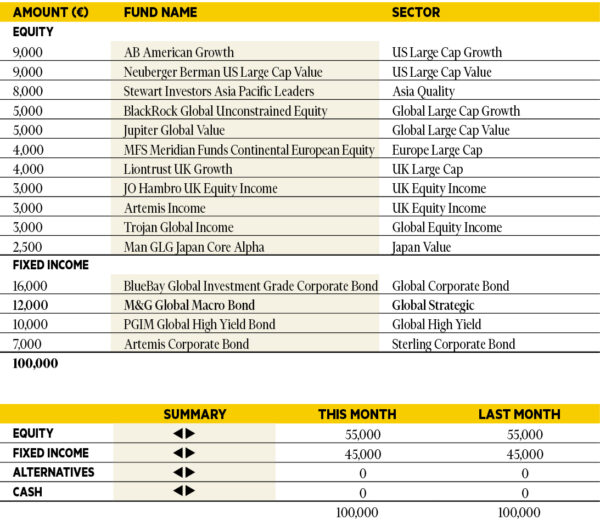

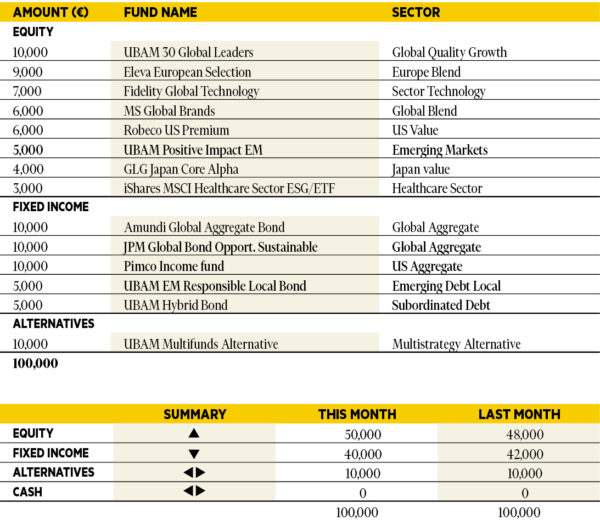

Didier Chan-Voc-Chun

Head of Multi-Management and Fund Research at Union Bancaire Privée (UBP).

Based in: Geneva, Switzerland

“Disinflation continues globally, at different rates between total and core inflation, with developed countries aiming for a 2.5 per cent inflation rate by year-end. Central banks confirmed they have reached peak interest rates, signalling upcoming easing, which, according to our scenario, is expected at the end of the second quarter. The robust US economy is attributed to fundamental strengths compared to Europe and Japan. Our portfolio remained unchanged throughout the month.”