Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy.

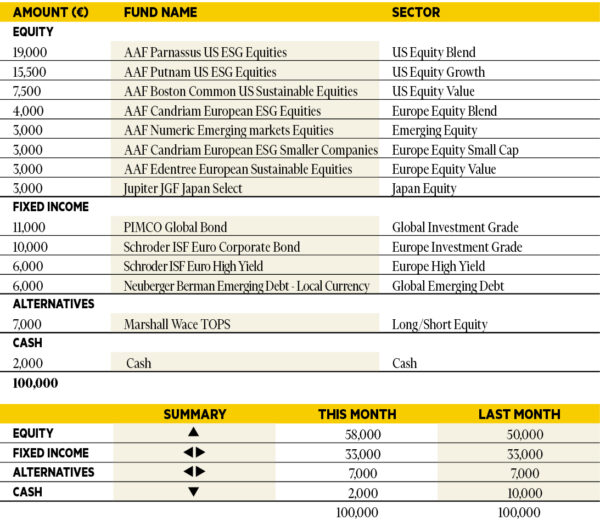

Benjamin Hamidi

Senior portfolio manager, ABN AMRO Investment Solutions.

Based in: Paris, France

“The US economy remained strong. The situation remains more complex in Europe, but activity has improved somewhat, with surveys pointing to renewed confidence, while credit conditions appear to be easing. Equities continued to rise, supported by solid earnings, while sovereign yields adjusted slightly after markets re-anchored expectations of interest rate cuts. We maintain a balanced approach with a contained duration, an overweight in US equities and a preference for US growth stocks over European equity strategies.”

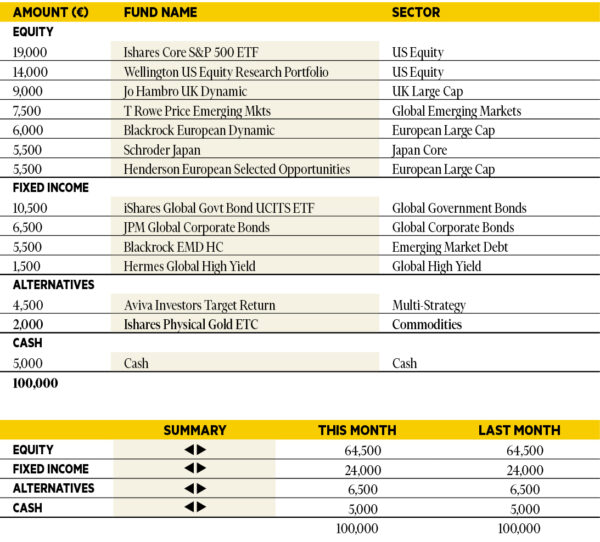

Luca Dal Mas

Senior fund analyst, Aviva Investors.

Based in: London, UK

“Latest GDP estimates for Q4 in the US confirmed the strong end to last year. GDP is now estimated to have risen by 3.4 per cent annualised. Early survey data shows a persistence of the positive trend in the manufacturing sector. These sorts of growth rates, alongside continued labour market strength, make it easier for the Fed to wait just a bit longer before making any decision to cut rates. Markets perceived the Fed approach as dovish, with equities continuing their positive trend, with European indices leading the way. Gold is now trading at all-time highs.”

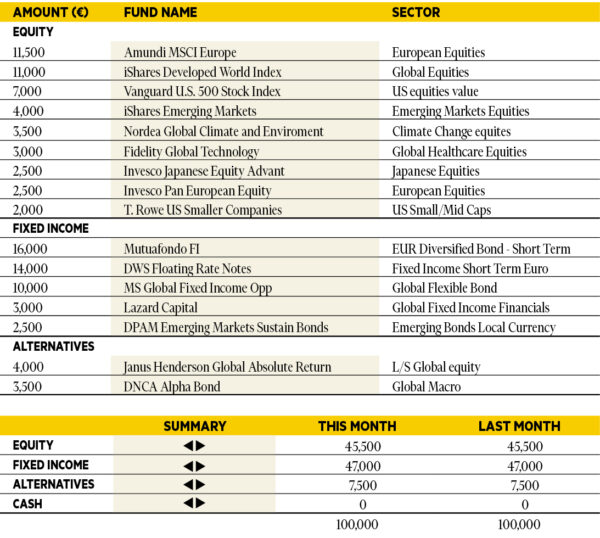

Jorge Velasco

Director of Investment Strategy, CaixaBank Private Banking.

Based in: Madrid, Spain

“We maintain a positive outlook for the coming weeks. We made a couple of minor changes to the portfolio. On the one hand, we changed the bias of the climate change fund and went from a fund biased towards Europe and a value style to one more in line with what is usual within the sector, with greater weight in the US and a greater growth profile. On the other hand, we closed the position in quality growth that we opened a few months ago and entered a European equity fund with a value bias, trying to take advantage of the recent democratisation of returns on the stockmarkets.”

Adam Norris

Investment Manager in the Multi-manager team, Colombia Threadneedle Investments.

Based in: London, UK

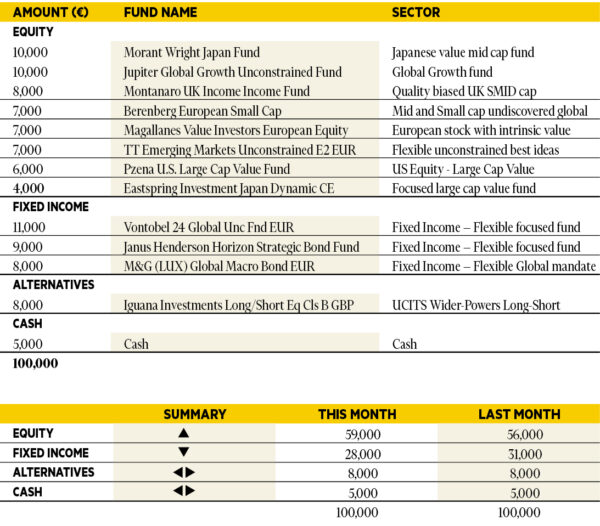

“Bullish market sentiment continued to drive equity markets higher. This resilience encouraged more cyclical sectors to outperform, which can be seen through the performance of the Pzena US Large Cap Value Fund, and the European value-focused Magallanes Value Investors UCITS Fund. We continued to add to equities at the expense of fixed income. Our regional preference remains Japanese equities, which we added further to through the Morant Wright Japan Fund. We trimmed our only alternative holding after a period of strong performance.”

Silvia Tenconi

Multimanager Investments & Unit Linked, Eurizon Capital SGR.

Based in: Milan, Italy

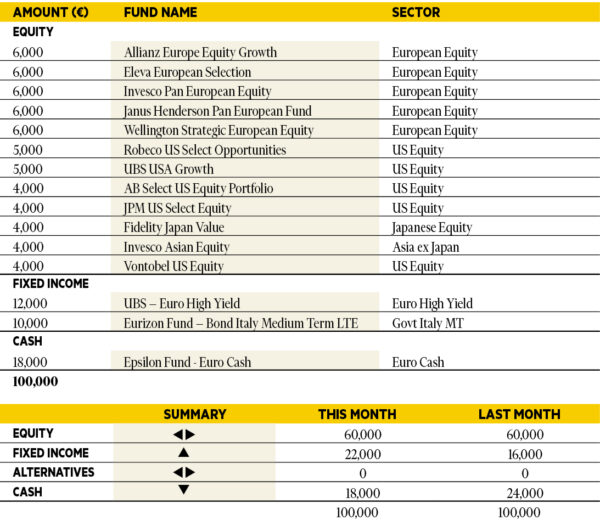

“In March the performance of the portfolio was positive, with Wellington Strategic European Equity and Eleva European Selection contributing the most. Interest rates in Europe seem to have peaked, retracing half the movement they made in the fourth quarter of 2023. We deem these levels to be a good entry point to deploy some cash. The rally in equities has been strong year to date: we keep a moderate exposure there. Credit is still favored in our opinion, even though valuations are now fair, and we keep our exposure there unchanged.”

Richard Troue

Fund Manager, Hargreaves Lansdown Fund Managers.

Based in: Bristol, UK

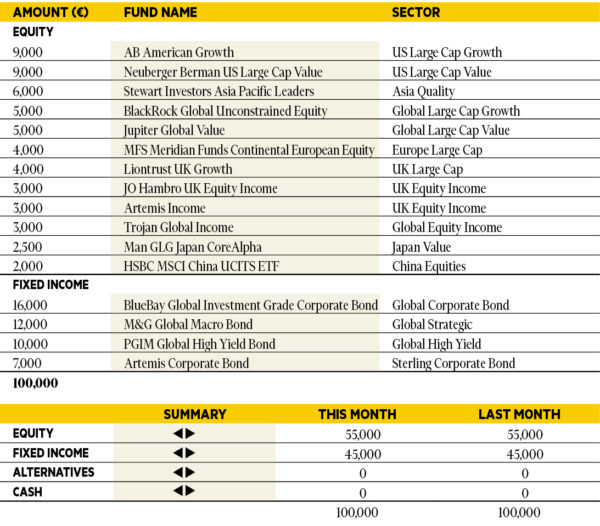

“China divides opinion. To some it’s uninvestable, to others the future. The reality is probably somewhere between. But it’s cheap relative to history. Is the negativity overdone? ‘Short China’ has been a popular trade and sentiment could improve. The portfolio has very little direct exposure to China. I’ve therefore added HSBC MSCI China UCITS ETF and reduced Stewart Investors Asia Pacific Leaders Sustainability. The latter is significantly overweight India which has worked well. This banks some profit and provides the opportunity to tactically benefit from a China rebound.”

Paul Hookway,

Senior Fund Analyst, Kleinwort Hambros.

Based in: London, UK

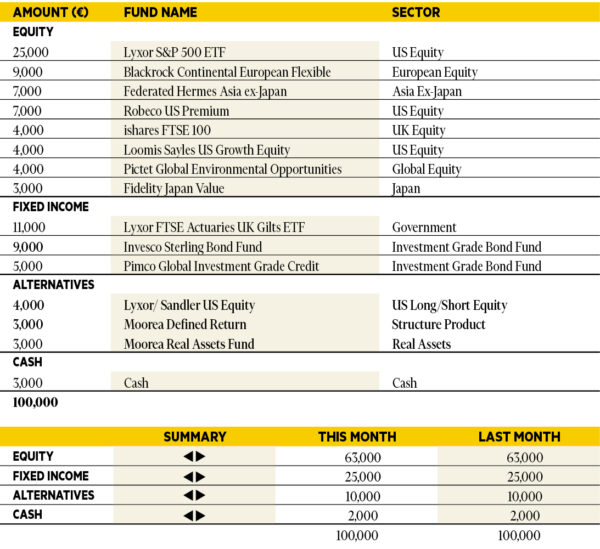

“While inflation has declined in developed markets, central banks as yet have not cut rates, despite base rates offering attractive real returns for the first time in many years as inflation has fallen steadily over recent months. The US economy in particular is performing well. Bond markets reacted negatively and it’s not surprising rates remain unchanged. We still expectthem to fall later in 2024, but the exact timing continues to be uncertain. We didn’t make any changes; equities are looking expensive, though at this stage we decided no action was required.”

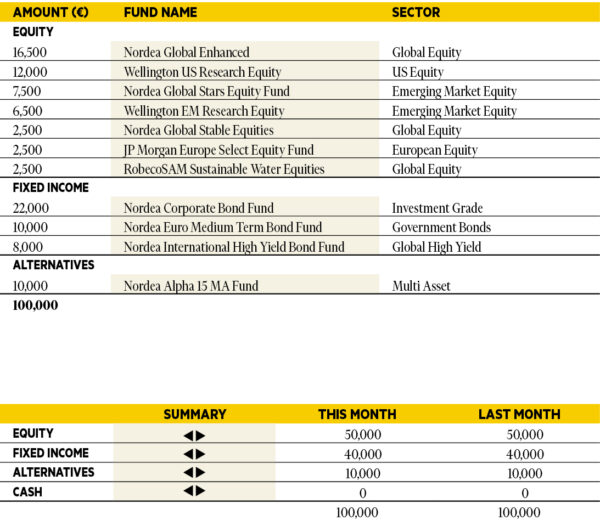

Antti Saari

Chief Investment Strategist, Nordea investments.

Based in: Copenhagen, Denmark

“Strong economic growth is good for companies’ earnings. Indeed, firm growth is the main reason why we recommend overweighting equities versus fixed income. The rise in equities has become more broad-based over the past months. The big tech companies which have driven much of the upswing until recently are highly valued. This, combined with elevated investor optimism, increases the risk of a small, short-term correction. On the other hand, the upcoming earnings season and overall strong fundamentals will limit the scope of any pullback.”

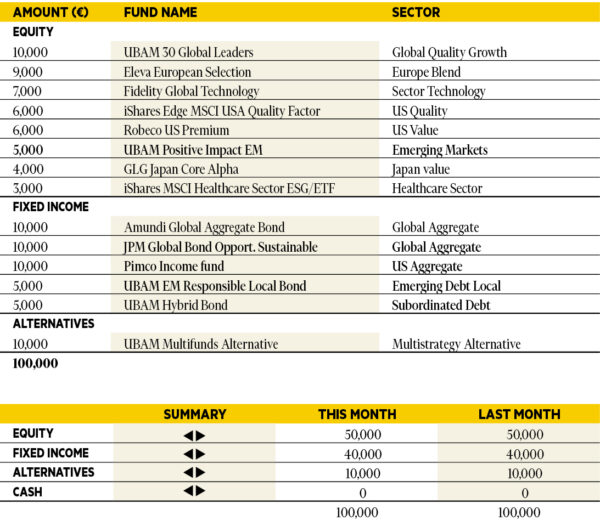

Didier Chan-Voc-Chun

Head of Multi-Management and Fund Research at Union Bancaire Privée (UBP).

Based in: Geneva, Switzerland

“Global growth remains resilient thanks, in part, to a stronger contribution from the US, where growth should continue to outperform other developed markets. As earnings season comes to an end, US tech companies have demonstrated strong results, beating expectations. Earnings per share in tech are higher than those in other segments. These dynamics support our decision to overweight our allocation to the US. We decided to increase our allocation to quality in the US with the proceeds from the sale of one of our global equity managers.”