Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy.

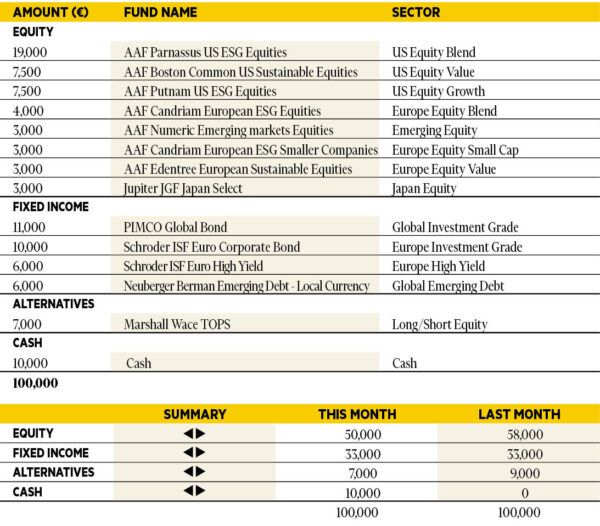

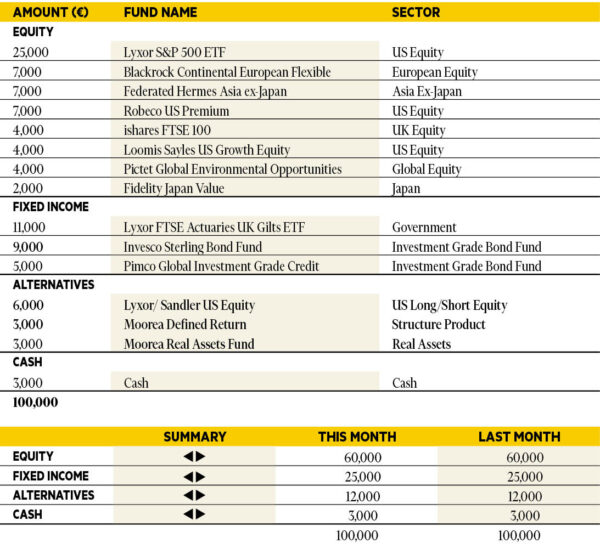

Benjamin Hamidi

Senior portfolio manager, ABN AMRO Investment Solutions.

Based in: Paris, France

“The US economy remains underpinned by consumption and public spending, but leading indicators point to a modest slowdown, which should allow the labour market to rebalance. Persistent disinflation, signs of weakness in the labour market and falling activity indicators have prompted investors to anticipate six further rate cuts in 2024, leading to a rapid easing in US yields. In the eurozone, the weakening in activity, consumption and confidence is more pronounced, and credit conditions continue to deteriorate. Against this backdrop, we are maintaining a moderate exposure to global equities, with a preference for US equities and a cash position to be deployed as opportunities arise.”

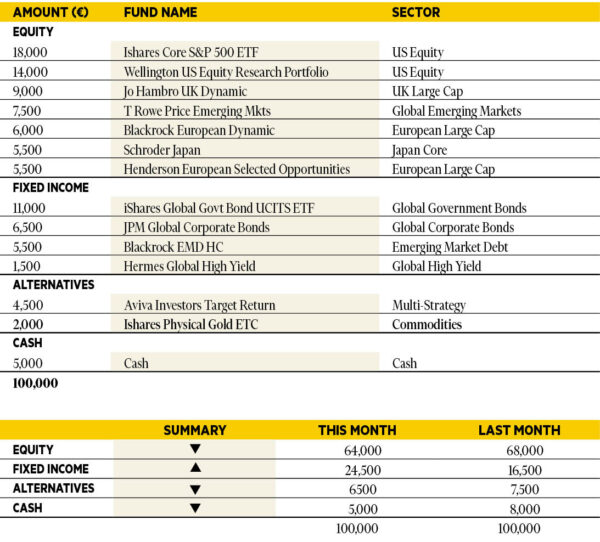

Luca Dal Mas

Senior fund analyst, Aviva Investors.

Based in: London, UK

“During the month, while the Fed decision to leave rates unchanged was expected, equity and credit markets liked what they heard and rallied to new highs in the US and eurozone while the dollar weakened. Previous concerns around core services inflation are now gone, with Fed chair Jerome Powell noting that goods, housing and non-housing services were all contributing to slowing inflation. Early survey data showed that manufacturing is slightly weaker in the US and UK but unchanged in the eurozone, while the reverse is true for services. In portfolios we have taken the opportunity to rebalance our exposure. On the equity front, we have slightly reduced our European exposure, while US equities remain the larger allocation.”

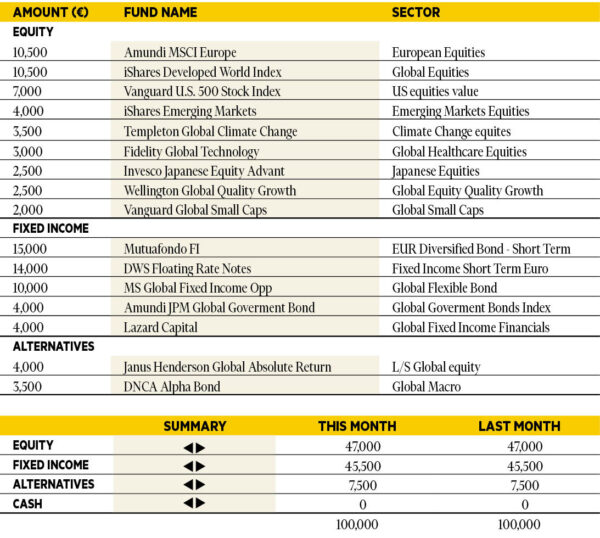

Jorge Velasco

Director of Investment Strategy, CaixaBank Private Banking.

Based in: Madrid, Spain

“We started the year as we ended 2023, for the time being seeking a certain balance between large asset masses and maintaining neutrality in terms of geographic, sector and style distribution. Within this balance, we continue to favour fixed income over alternatives, despite the recent good performance of practically all fixed income assets, which we believe continue to offer interesting yield levels for the coming months. The slowdown in the US cycle offset by moderate growth in corporate earnings may keep stockmarket indices in their current sideways ranges.”

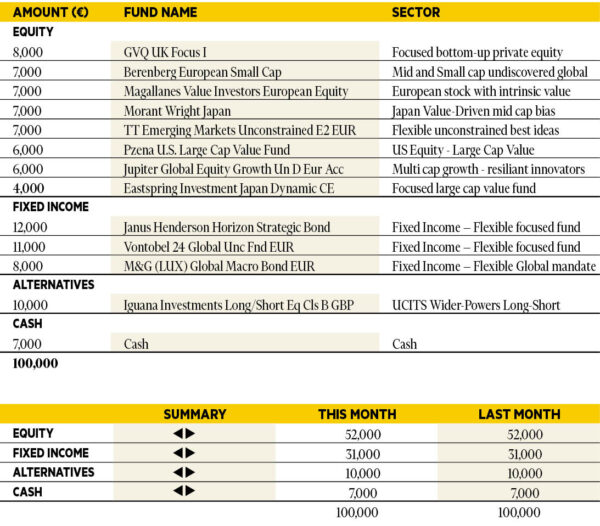

Kelly Prior

Investment Manager in the Multi-manager team, Colombia Threadneedle Investments.

Based in: London, UK

“The Santa Claus rally was alive and well at the end of 2023, with a softer tone from the Federal Reserve alongside a shift in the ‘dot plot’ indicating that the members of the committee expect rates to moderate from here. Risk and duration assets rallied globally despite a more moderate tone from other central bankers. The US was the strongest major market, but it was the Berenberg European Smaller Companies fund that led the selection, with Eastspring Japan Dynamic the laggard. The volatility of the move shows just how the market can react when repricing new information. Expect more of this (both up and down) during 2024.”

Silvia Tenconi

Multimanager Investments & Unit Linked, Eurizon Capital SGR.

Based in: Milan, Italy

“In December, the performance of the portfolio was positive once again, with Allianz Europe Equity Growth being the standout performer. The only negative contributor was Amundi MSCI China UCITS ETF. Markets have repriced their expectations on the direction of rates, now discounting a very positive outlook, maybe a bit too optimistic in our view. We deem it appropriate to moderate risk in our portfolio, cutting equity exposure across the board and closing our position on China to buy cash, albeit being still positive on risky assets in the medium term.”

Richard Troue

Fund Manager, Hargreaves Lansdown Fund Managers.

Based in: Bristol, UK

“If 2023 was all about central banks and the path for interest rates, 2024 could be all about politics. Elections will take place in many major economies. Political machinations and policies designed to win votes could fuel market volatility. Throw in the potential for central banks not to cut interest rates as much as is priced in, and you have the recipe for an interesting year. As fascinating as these events are to observe, investment decisions need to be made for the long-term. While I’ll look out for long-term valuation anomalies these events throw up, my main aim is to maintain a diversified and balanced portfolio that’s rebalanced regularly.”

Paul Hookway,

Senior Fund Analyst, Kleinwort Hambros.

Based in: London, UK

“Rates were again unchanged in December, allowing markets to factor in rate cuts in the first half of 2024. The recently published Fed minutes did contain language which could moderate these views. Global equity markets are now in positive momentum, thanks to the recent rally in November and December, a signal for us to consider increasing our equity allocation. We do need see this to continue over the next few months, combined with a number of other factors, before we could sensibly increase the portfolio’s equity allocation.”

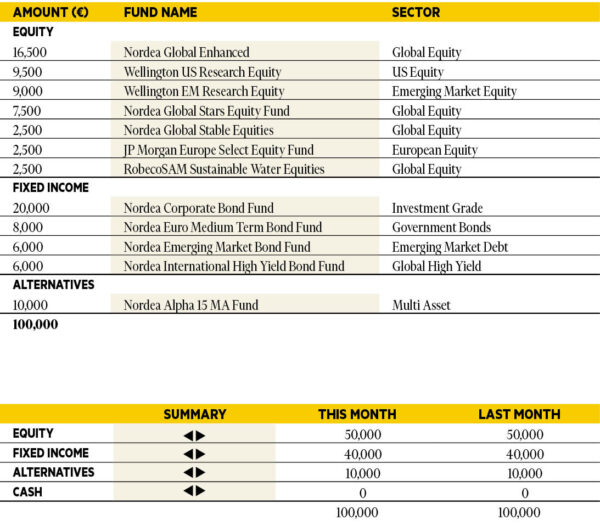

Antti Saari

Chief Investment Strategist, Nordea investments.

Based in: Copenhagen, Denmark

“We think the equity market uptrend will continue this year. Wage and price pressures are on their way down and central banks are signalling that the peak in interest rates has been reached. This means the focus will be on what usually drives the stockmarket: economic growth and earnings. With prospects for decent growth in the economy and slowing wage-cost pressures, it is likely that companies’ earnings will grow again after a tough period. In such an environment, equities normally perform better than bonds, even with interest rates at today’s levels. Notably, global equity valuations are at around their long-term average and as such more attractive than euro-denominated bonds even in a historical comparison. We maintain an overweight in equities and an underweight in bonds. We seek some return pick-up from investment grade corporate bonds, as credit spreads in that space are still attractive in a historical comparison. Within equities, we overweight emerging markets due to their improving earnings growth and rather modest valuation.”

Didier Chan-Voc-Chun

Head of Multi-Management and Fund Research at Union Bancaire Privée (UBP).

Based in: Geneva, Switzerland

“Slowing economic growth allowed inflationary pressures to ease in transatlantic economies. Fiscal stimulus in both the US and Europe pre-empted widely anticipated recessions in 2023 and we believe this economic support, though generally focused on the industrial sector, will be maintained. US and European bond yields closed the year near the targets of 4 per cent on 10-year US Treasuries and near 2 per cent on German Bunds. An expected pause in rate hikes, first by the ECB and later by the Fed, should allow yields to retreat in 2024. In the portfolio, we decreased our emerging market exposure in favour of developed markets. We also slightly increased our equity exposure. On fixed income we added to a global alpha-centric strategy and reduced passive exposure.”