Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy.

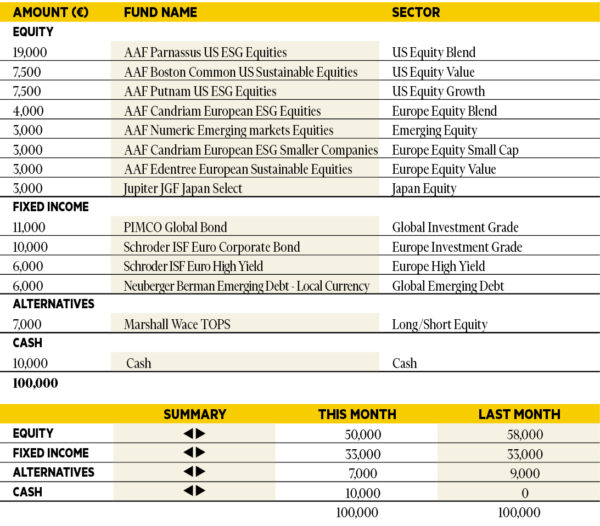

Benjamin Hamidi

Senior portfolio manager, ABN AMRO Investment Solutions.

Based in: Paris, France

“Consumer spending in the US remains robust, thanks in particular to a job market that remains tight. The Fed hinted that it is probably not yet ready to cut rates in March, and will await confirmation of the data. The situation in Europe is stagnant, with limited growth potential and credit conditions that could weigh further on the outlook. We are keeping a moderate exposure to global equities and a contained duration, with a preference for US over European equities. A cash position is maintained to provide tactical room for manoeuvre.”

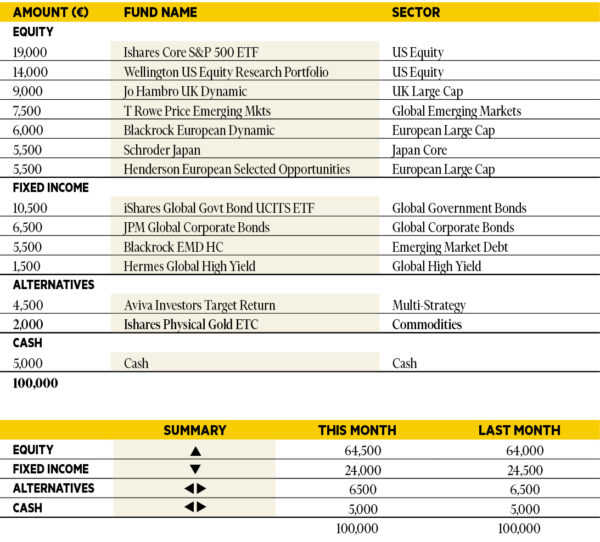

Luca Dal Mas

Senior fund analyst, Aviva Investors.

Based in: London, UK

“The latest US GDP and PCE data have been supportive of a soft landing scenario. The Atlanta Fed’s estimates for current GDP is running at 3 per cent and the NY Fed’s Nowcast is similar. The latest survey data continue to show that the manufacturing weakness that started in mid-2023 is now improving, typically bullish for asset markets. The services side is more complicated, with the UK, US, and Japan in expansion with Europe and Australia stalling. We marginally increased our allocation to US equities by reducing exposure to Europe and government bonds.”

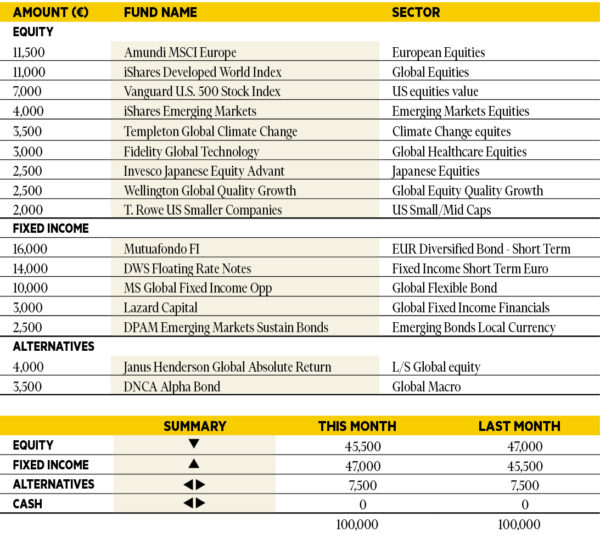

Jorge Velasco

Director of Investment Strategy, CaixaBank Private Banking.

Based in: Madrid, Spain

“We are introducing new changes to adjust the portfolio to our vision for 2024. We increased the weight of equity in the portfolio, which we favour over fixed income and expect to perform well this year. We adjusted the duration downward in fixed income while introducing a new investment idea, emerging debt in local currency. We have increased the relative weight of Europe within equities while changing our focus from small caps, which we had previously invested in with a global index fund, to small caps with an actively managed fund focused on the US.”

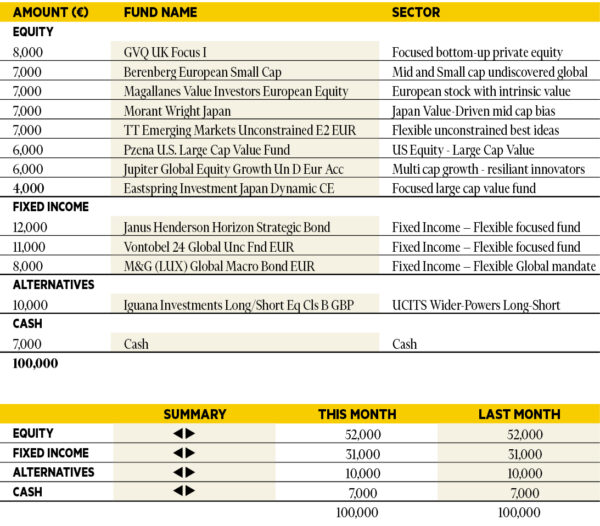

Kelly Prior

Investment Manager in the Multi-manager team, Colombia Threadneedle Investments.

Based in: London, UK

“Talks of higher for longer rates in the face of stubborn inflation and solid growth bolstered developed markets while Asia and emerging markets faltered as headwinds for China continue. Japan was the strongest market as corporate reform garnered interest from foreign investors. The US-focused Jupiter Global Equity Growth Unconstrained fund topped the performance table, with the Berenberg European Smaller Companies at the bottom. It feels like 2024 is going to be a year with many changes of narratives with all the volatility, but also the opportunities, this can bring.”

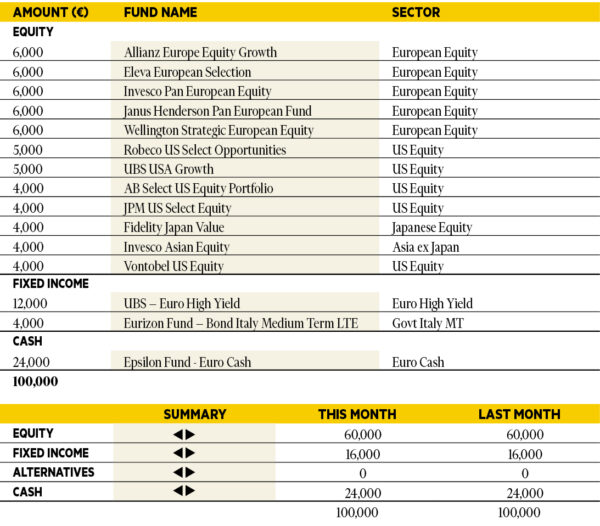

Silvia Tenconi

Multimanager Investments & Unit Linked, Eurizon Capital SGR.

Based in: Milan, Italy

“In January, the performance of the portfolio was positive, with UBS USA Growth and AB Select US Equity contributing the most. January was a good month for equities and credit assets, even though interest rates resumed their path upwards, as central banks signalled their cautiousness on starting to cut rates too soon. The US job market is still strong, and the earning season is yielding satisfactory results so far. That said, valuations are not enticing anymore. We keep our buffer of cash and wait patiently for a better entry point.”

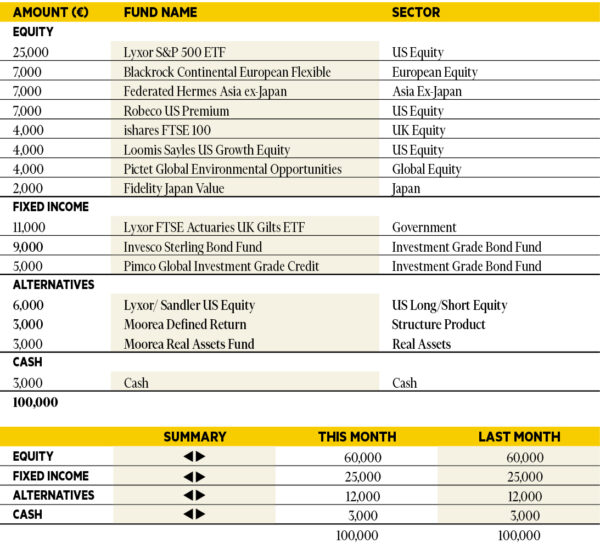

Richard Troue

Fund Manager, Hargreaves Lansdown Fund Managers.

Based in: Bristol, UK

“It has been interesting talking to our UK managers recently. Nobody wants to buy UK shares, so companies are buying their own. With fewer shares in issue future earnings and dividends will be enhanced. They also report many companies have strong balance sheets and are performing well operationally. A combination of low valuations and strong fundamentals shouldn’t be ignored. There are risks, but attractive dividends can offset these somewhat for those who are patient. I therefore remain a happy holder of the likes of JOHCM UK Equity Income and Artemis Income.”

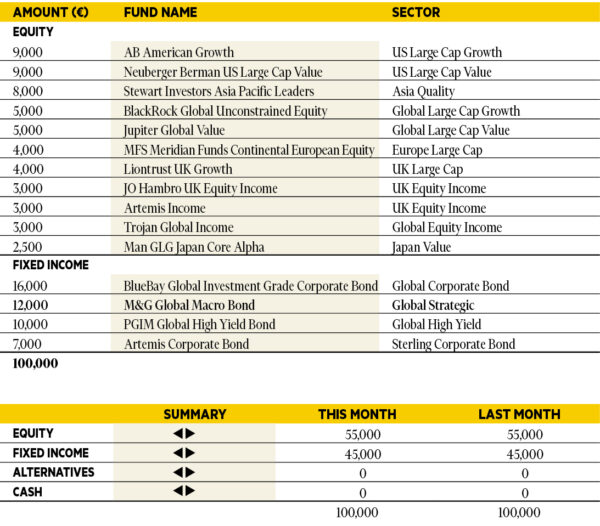

Paul Hookway,

Senior Fund Analyst, Kleinwort Hambros.

Based in: London, UK

“Inflation rose slightly in the UK, thanks to increased duty on cigarettes and alcohol, though we still see inflation falling in the coming months, though it may be a bumpier ride than we would like. Rates remained unchanged in the US and UK. There had been only a small chance that rates would be cut, though markets reacted negatively; we were somewhat surprised by this over reaction. We made no changes to the portfolio. The recent increase of its fixed income duration exposure added value as did the timely sale of gold in Q4 2023 as did adding Loomis Sayles US Growth Equity.”

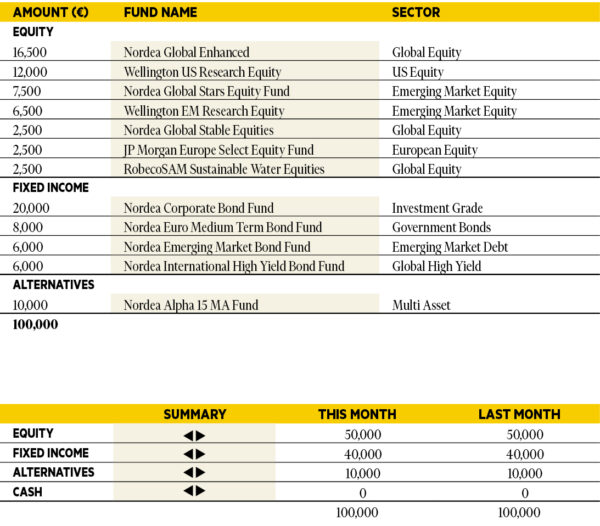

Antti Saari

Chief Investment Strategist, Nordea investments.

Based in: Copenhagen, Denmark

“We expect the uptrend in equities to continue, and although we expect bonds to do well this year, we think equities will do better. Spreads are now fairly tight as the macroeconomic backdrop has improved and from the current levels investors can assume only modest spread tightening. However, investment grade corporate bonds offer attractive carry versus government bonds and we are overweight. Within equities, we remove the overweight in emerging markets as there is a risk that Chinese stocks will continue to weigh on performance.”

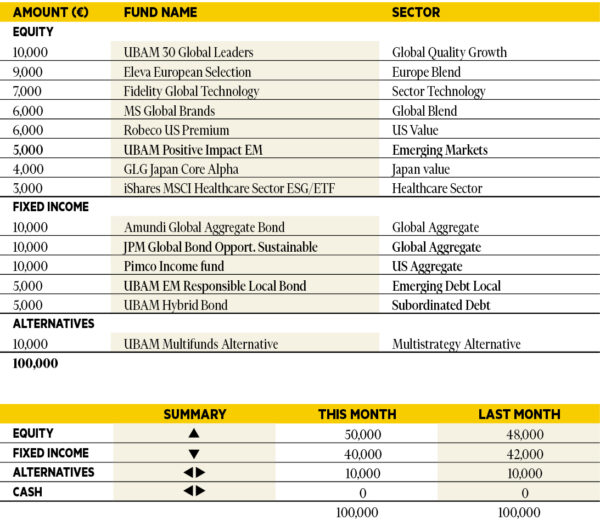

Didier Chan-Voc-Chun

Head of Multi-Management and Fund Research at Union Bancaire Privée (UBP).

Based in: Geneva, Switzerland

“A yield curve above 4 per cent not only gives fixed income an attractive carry, but it also means bonds now have more cushion not only to absorb shocks from higher rates/spreads, but also to work together with equities. This means investors can now earn attractive returns in the comfort of developed market investment-grade bonds. The consolidation of equity markets at the start of the year reflects market debate around the timing of rate cuts, continued geopolitical tensions and weak Chinese macro data. However, we believe any pullback should be taken advantage of.”