Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

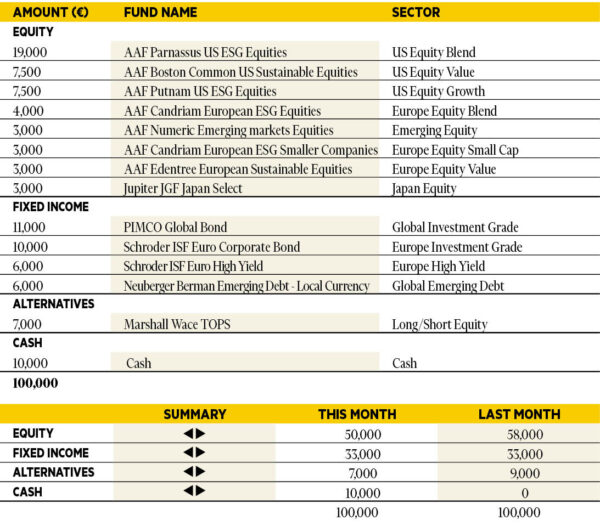

Benjamin Hamidi

Senior portfolio manager, ABN AMRO Investment Solutions.

Based in: Paris, France

“The market seems to have switched to a scenario of lower rates and rapid convergence of inflation towards central bank targets. For the time being, US growth is moderating only slightly. However, economic surprises, previously favourable, are becoming less so, contrasting with the rebound in risky assets, which are benefiting above all from the recent easing in interest rates. In this context, we are maintaining a moderate exposure to global equities, with limited active risk, but with a preference for US equities and a cash position to take advantage of future opportunities.”

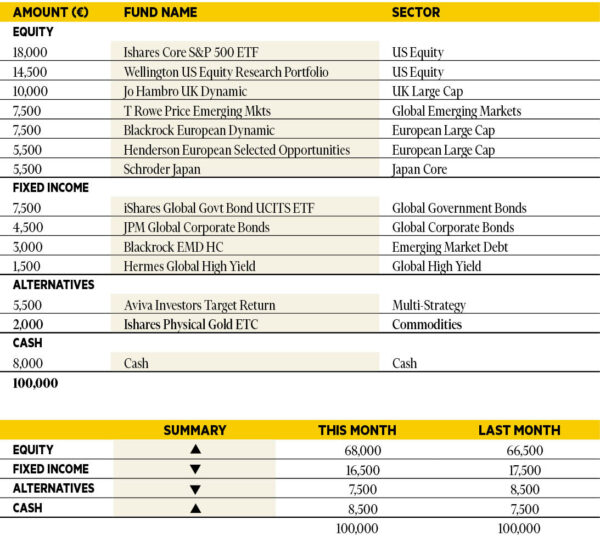

Luca Dal Mas

Senior fund analyst, Aviva Investors.

Based in: London, UK

“Earlier in the month, following the Fed signalling a pause in tightening and the deceleration in US job gains, markets rallied strongly and interest rates started to fall. November saw most equity markets recover a good portion of the ground lost since the temporary peak during the summer. On the economic front, early survey data showed major European economies are still in contraction, albeit at a slightly slower pace in both manufacturing and services. We have closed our underweight in emerging markets and used the opportunity coming from central banks’ dovish stance to increase our overall risk exposure.”

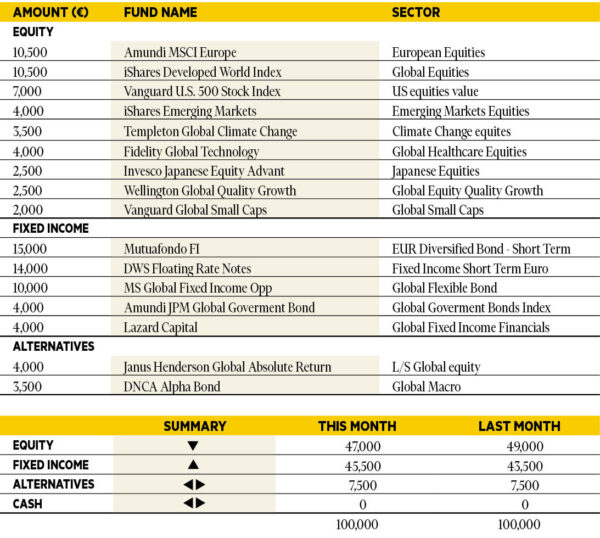

Jorge Velasco

Director of Investment Strategy, CaixaBank Private Banking.

Based in: Madrid, Spain

“Given that the inertia of global economic growth is maintained although the composition is altered, less US, but more Europe and China, we continue with the neutral level of investment in stocks, although we slightly alter the geographical composition of the portfolios, putting more focus on the old continent, which is also favoured due to attractive valuations. The slowdown in the US cycle, offset by moderate growth in corporate earnings, may keep stockmarket indices in their current sideways ranges. We remain cautious on the dollar due to the weakening US economy and note an improvement in materials expectations, but crude oil may suffer volatility if Opec relaxes its discipline. In the last move of the year, we moved the portfolio to a more balanced area in terms of risk from the defensive positions we have held throughout 2023. In the fixed income block, in addition to reducing its overall weight in the portfolio, we balanced the duration at around three years while adding a flexible fund with attractive yield levels.In the equity block, we are repositioning the portfolio by seeking a geographic and sector exposure of a certain neutrality.”

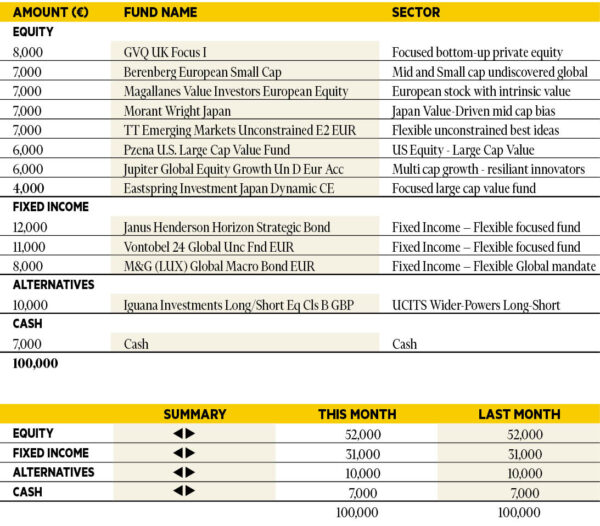

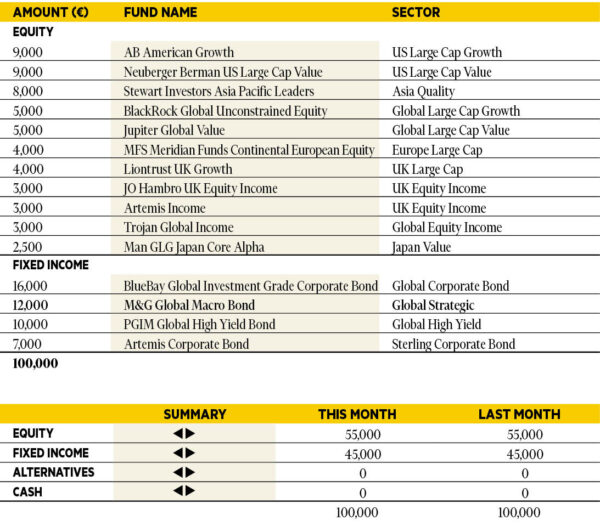

Kelly Prior

Investment Manager in the Multi-manager team, Colombia Threadneedle Investments.

Based in: London, UK

“The soft-landing narrative took on a life of its own in November, with a slight easing in inflation being all that was needed to change the mood music in markets. Europe led the move upwards, but it was a universally positive shift despite the central bankers of developed markets remaining on message on higher rates for longer. The high beta rally saw smaller companies catch a bid with the Spyglass US Growth fund the leader of the selection. The fund is being replaced with the predominantly US invested Jupiter Global Growth Unconstrained fund – a larger cap growth exposed vehicle with a penchant for resilient innovators.”

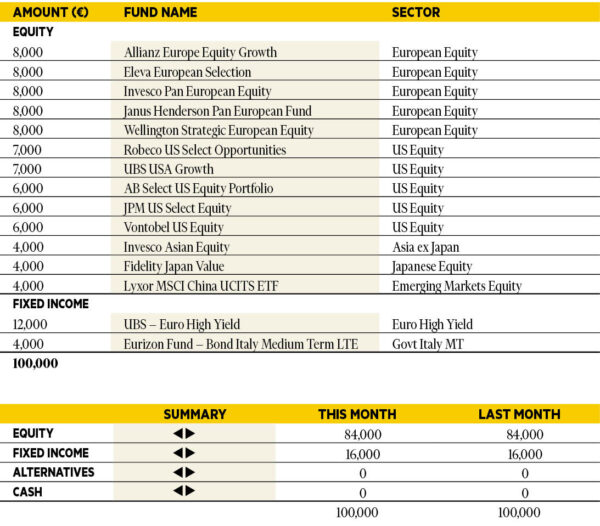

Silvia Tenconi

Multimanager Investments & Unit Linked, Eurizon Capital SGR.

Based in: Milan, Italy

“In November, the performance of the portfolio was very positive, with Allianz Europe Equity Growth being the best contributor by far. No negative contributors at all. Both the ECB and the Fed have moderated their restrictive attitude and markets are starting to price in a plateau of rates, if not an outright pivot. Inflation numbers are surprising to the downside and volatility in the Fixed Income market is coming down. We keep our allocation unchanged for now, as we see a possible continuation of the rally into year-end.”

Richard Troue

Fund Manager, Hargreaves Lansdown Fund Managers.

Based in: Bristol, UK

“There hasn’t been much to cheer about this year. But as 2023 draws to a close there are some positives to take into next year. Chief among them is lower inflation, which should ease pressure on consumers, particularly if interest rates fall in response. Fixed interest markets have rallied in anticipation of this, but there could be more to come if things continue to improve. I certainly see value in having exposure to high-quality government and corporate bonds, for the yields on offer today, plus the useful role they could play if rates start to come down in 2024.”

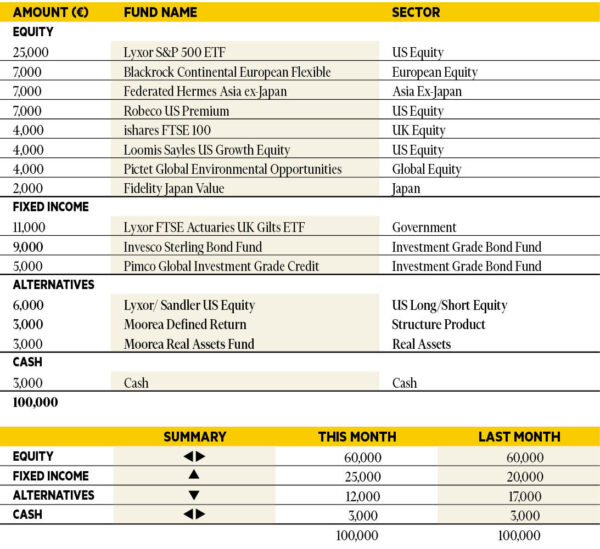

Paul Hookway,

Senior Fund Analyst, Kleinwort Hambros.

Based in: London, UK

“After the rise in risk aversion in October, November saw a rapid change in investor sentiment as Inflation in developed markets reduced significantly, resulting in rate rises being remaining paused for the time being. The attraction of bonds over other alternatives has a firm base with reducing probabilities of further rate increases. In particular the ongoing rally in government bonds demonstrates and shift in sentiment. To this end we sold our gold position and trimmed our other alternative positions to fund a new holding of Pimco Global Investment Grade Credit, increasing the fixed income allocation to 25% per cent of the portfolio.”

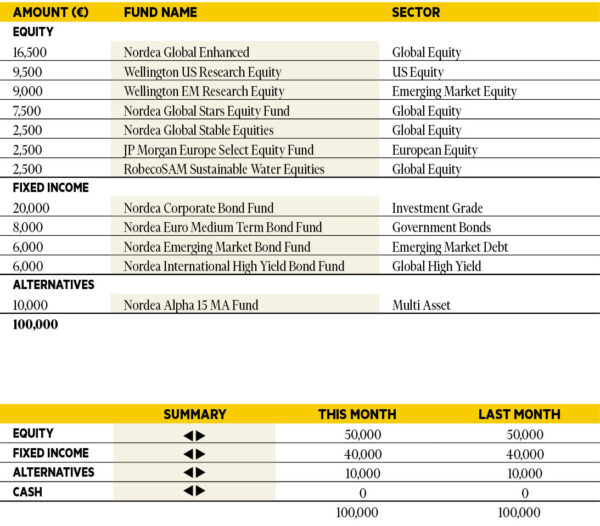

Antti Saari

Chief Investment Strategist, Nordea investments.

Based in: Copenhagen, Denmark

“We think the equity market uptrend will continue in 2024. Wage and price pressures are on their way down and central banks are signalling that the peak in interest rates has been reached. This means the focus will be on what usually drives the stockmarket: economic growth and earnings. With prospects for decent growth in the economy in 2024, it is likely that companies’ earnings will grow again next year after flat development in 2023. In such an environment, equities normally perform stronger than bonds, even with interest rates at today’s levels. We maintain an overweight in equities and an underweight in bonds. We seek some return pick-up from investment grade corporate bonds, as credit spreads in that space are still attractive in a historical comparison. Within equities, we overweight emerging markets due to their improving earnings growth and rather modest valuation.”

Didier Chan-Voc-Chun

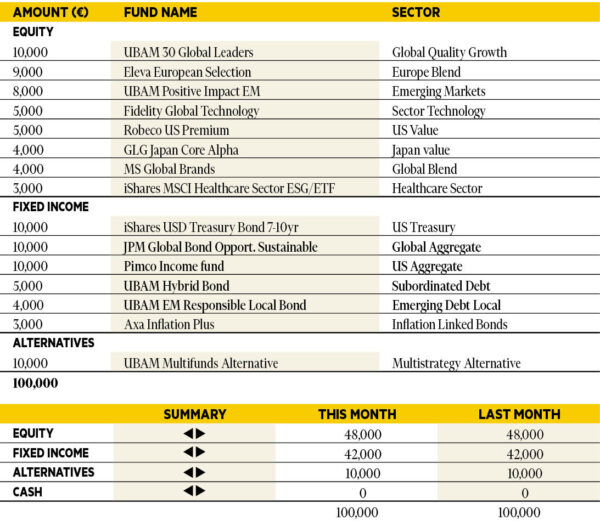

Head of Multi-Management and Fund Research at Union Bancaire Privée (UBP).

Based in: Geneva, Switzerland

“Global growth is expected to stabilise at a rate of 2.9 per cent in 2024 after a 3 per cent increase in 2023. The global economy is holding up better than expected, but risks remain due to a fragile geopolitical balance. As in 2023, the prospects for 2024 appear much better for the US than for other developed countries. The US’s solid consumption and the recovery of its manufacturing sector provide a basis for growth that other developed countries do not offer, and one against which China is competing in the race for global pre-eminence. We have maintained our exposure to developed markets and reduced that to emerging markets.”