Geopolitics involving Russia, China and the Middle East is increasingly influencing asset prices, though investors have been ill-prepared to measure risk associated with this changing tide of international relations.

The perception that geopolitical risks are increasing is the consensus view these days. Events in recent weeks in the Middle East have only served to reinforce this. Suffice to say that getting the important geopolitical calls right is now seen as critically important for business – or at least you don’t want to be on the wrong end of the key calls.

The importance of geopolitics for business and markets was laid bare in 2022, when many businesses got the call on the Russian invasion of Ukraine wrong and suffered big P&L hits. Many Western companies were left holding assets subject to sanctions or with assets stranded in Russia. The Western entities were unable to offload these or subject to punitive sale conditions imposed by the Russian state.

With hindsight now, the reality is that Western business had been misreading Russia under Vladimir Putin for years, not just in 2021-22, adopting a far too sanguine view of geopolitical risks around Russia. The problems were long in the making – and perhaps by 2022, for many it was already too late to exit.

On the Russia call, in particular, there were lots of explanations for Western business getting it wrong. These range from: ignorance/arrogance; wishful thinking given many Western businesses were very/over committed already; failing to read clear warning signs from their own governments; to a corrupted information set as Russia infiltrated Western institutions giving the messages; to viewing Russia through the wrong prism and assuming Mr Putin was logical, like us, and not a brutal authoritarian with an obsession with Ukraine and in putting right what he saw (incorrectly) as the injustices done to Russia in the past. If you managed to get into Mr Putin’s mindset it was entirely logical that he went for a full scale invasion of Ukraine in 2022 – that was my view at the time, and in fact dating back to 2015.

The point is though that geopolitics is important but difficult I think for business to get right. Partly I think this reflects the core, or essence, of what geopolitical risk is. The dictionary definition likely would suggest it is the interplay between foreign affairs, defence/security with the economy and markets. The problem therein is that it is a multidisciplinary subject. Diplomats or security types might be able to figure out one dimension of this – is a war or invasion likely to happen, are sanctions likely – but they might lack the economics, business or markets experience to figure out what the economy or market impact might be. Similarly, someone coming at it from the business or markets angle might be able to fairly accurately calculate the market impact of a geopolitical event but might find it hard to determine whether an event is going to happen or attach an accurate probability to that event.

Notable these days that lots of banks, investment firms and businesses are hiring ex diplomats, generals and admirals to help them with geopolitical risk, but they might not be best placed to figure out the real economic, business or market impact. Best I think to try and adopt an all-round holistic approach – understand what you don’t know, the infamous Rumsfeldian ‘known unknowns’ and seek to fill the information gaps from all possible sources.

The obvious problem with the perception that geopolitical risks are rising is to simply hold one’s hands up and admit in horror, that the world is a horrible, unsafe, and uncertain place – it is easy then to go into paralysis and do nothing. But I think by using a holistic approach it is possible to understand risks around geopolitical events or threats, figure out probabilities and then try and price risk.

The reality is that geopolitical risk has been around almost as long as some of those oldest professions in the world. I think if you had been at the end of the sword of the Imperial Roman expansion, Viking raids on the west coast of Europe, the Norman Conquest of Saxon England, or Western colonialism you would have well understood the downsides from geopolitical risk, albeit you might not have called it that. Fast forward to the first and second world wars and it’s evident that geopolitical risks were there but not really called as such. More like imperialism, colonialism and plain and simple war and conquest.

Changing seasons

But I think something seems to have changed in very recent years, and perhaps stands in some contrast to years back in very recent memory. Partly, that reflects I think relative geopolitical calm, or perhaps easier geopolitical set ups to figure out up until perhaps the GFC, or thereabouts, perhaps pushing out to the Arab Spring around 2010/11.

First, I would delineate the Cold War as a period where you had two distinct blocs and then a non-aligned crew trying to stay beyond the reach (out of trouble) of those blocs. But the Nato and then the Warsaw Pact blocs limited the number of geopolitical players to figure out, with a near score of countries in each bloc, others such as the Gulf states then seeking safety under the wing of the US. Nato and the Soviet-dominated Warsaw Pact engaged in brutal proxy wars across the globe which were near fatal for those caught in those conflicts, and some of these, for example the Cuban missile crisis, or later the Greenham Common missile crisis (we only recently came to understand how close we came to nuclear destruction in the 1980s), came close to global catastrophe. But, arguably, guiderails were provided by the ultimate deterrent, the prospect of mutual nuclear destruction. The core relationship, or geopolitical risk, was around the Moscow-Washington relationship, and there were just fewer moving parts to figure out.

The collapse of the USSR heralded a period of a unipolar world, dominated by the US, and its own exceptionalism. The US was ascendant, even triumphal for beating communism, or so it thought. The US military machine was able to impose peace, or resolution, through exercise of might, in the first Gulf war, then Kosovo. What the US wanted it usually got, at least when it knew what it wanted and was focused on delivery therein. So that meant EU and Nato enlargement in Europe, among other things, and those made the recipients feel safer (with lower geopolitical risk?) suffice that they all went out and spent the peace dividend. Ironically this underinvestment in defence arguably laid the foundations for the current crisis in relations with Russia.

The US’s confidence and security in its own global domination encouraged it to surrender some sovereignty via its support for multilateralism and globalisation. The assumption with respect to then sub-peer rivals, Russia and China, was that in bringing them into the systems dominated by the US – global markets and trade – they would become like us, and all would benefit. We would all be wealthier and more secure as a result. But from a geopolitical risk perspective, the simplicity back then was figuring out what the US wanted first, and events followed an essentially US-driven course.

Now I know the comeback here will be 9/11, and how geopolitical practitioners got that so wrong. But I would even then still argue that in those early noughties years, at least, the world was still a pretty optimistic, joined up kind of place, and easier to figure out. I would highlight there the remarkable international co-operation in support of the US, post 9/11, in particular with Mr Putin – which seems remarkable now – allowing the US military to use bases in his backyard in central Asia to hit Al Qaeda in Afghanistan. Later, we saw the really unified response to the Global Financial Crisis, which spurred creation of the G20, and on counter terrorism, entities like the Financial Action Task Force (FATF).

Where did it all go wrong?

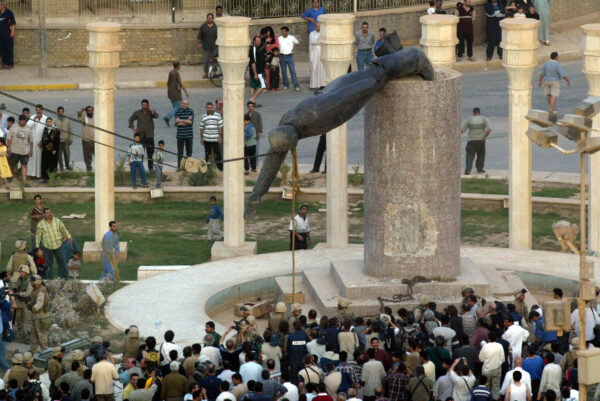

Perhaps enjoying too much of a good thing, the US and the West became complacent, even arrogant. The failed US intervention in Iraq in 2003 was something of a turning point. The cost in blood and treasure proved a confidence shock to the US, beginning to turn it towards isolationism and starting to crack the perception of the US as being invincible.

The GFC added grist to the mill in creating a global recession, higher unemployment and many of the policies in response – such as quantitative easing – increased global inequality. The toppling of Saddam in Iraq, the economic shock waves of the GFC fanning the Arab Spring, and Western indecision on Syria, and Libya, all combined with transport, telecommunications and social media revolutions. The result was that global inequality spurred huge new migrant flows.

All these factors together fed a new phenomenon of populism. As a result the US stepped back, vacuums were created and new global and regional players stepped into the void – including Russia, Saudi Arabia, Turkey, India and China.

New players, new ‘isms’ to figure out all added to the complexity of the geopolitical mix to get our heads around. The relative decline of the US and the West (Brexit has poleaxed the UK as a global power) and rise (and perhaps now decline) of China and the Global South are all part of this new mix.

A new multipolar world is the result, with added complexity for the geopolitical practitioner to figure out from added catalysts including climate change, migration, trade wars (onshoring, trade autarky) social media, and technology (AI). There are now just so many moving parts, that it’s all becoming very complicated.

Beijing longs for old global order

But within this I still think there are some stabilisers, at least for the time being.

The war in Ukraine has not, as some had suggested, created new blocs, or not just yet. China has not, as some have suggested, aligned and allied staunchly behind Russia. Beijing seems to long for a return to the global order harking back at least to the period prior to the Trump presidency, of globalisation and the multilateral world order that had allowed it to climb the global order of hegemony to within striking distance of the US.

China has been eager to distance itself from Russia, not supplying Moscow with its wish list of military kit and forcing Russia to resort to scraping the barrel, literally, by going cap in hand for drones from Iran and munitions from North Korea.

This US-China relationship is an anchor point for global geopolitics, both realising that. And I think in the war in Ukraine, China has clearly set limits on Mr Putin on things like use of weapons of mass destruction, which has been appreciated by the US, as were efforts at peacemaking by China earlier in 2023 however rudimentary and still Moscow-centred.

All this has been appreciated by the US and we have seen both sides try and stabilise the relationship at the recent Biden-Xi summit in San Francisco.

Now whether this new stability in the US-China relationship endures a second Trump term is open to question. But it does show that the US and China have some common interests, such as preventing escalation in the war in Ukraine, avoiding war in Taiwan, and de-escalating now in the Middle East – both want to keep a cap on energy and commodity prices.

The US stepping back from its prior exceptionalist path has created a vacuum for others to fill, but when it comes to regional powers, perhaps they are better placed to resolve conflicts in their own region. Note here Saudi Arabia’s new efforts to improve relations with Iran, partially brokered by China. And let’s face it, after disastrous recent US interventions in the region, including in Iraq and Afghanistan, I am not sure direct Gulf-Iranian peace efforts could do much worse.

In the Gulf region, in particular, the new focus is on economic development and reform with countries as diverse as Saudi Arabia, Oman and the UAE all having their own economic development visions. Many of these are inclusive, encouraging intra-regional investment, now extending to Iraq and Iran and bringing in China. Russia’s war in Ukraine did initially create a surge in energy prices, but this built buffers in various wealth funds, now deployed around the region to support development – from Iraq, to Iran, Turkey, Egypt, Pakistan and Tunisia. Investment in economic development should improve living standards, reducing social and political pressures, themselves ingredients to geopolitical risk.

Finally, climate change and the huge challenges therein can only be tackled through a multilateral approach seen now via COP28. We co-operate or we all suffer from climate change as seen from the ever increasing climate crises we are experiencing from wild fires to flooding. This is an existential threat to humankind, that is plain to see – that said, given the amount of carbon, polluting munitions expended in the war in Ukraine, perhaps few would realise this.

Timothy Ash is associate fellow in the Russia and Eurasia programme at Chatham House and senior sovereign strategist at RBC Bluebay Asset Management in London