A growing middle class, improving geopolitical situation and fundamentally sound companies all suggest there are investment opportunities to be found in China.

China has taken a significant step in shifting its fiscal stance, with the National People's Congress approving an additional Rmb1tn ($140bn) issuance of Chinese government bonds for the fourth quarter of 2023, which effectively increases the 2023 central fiscal deficit to 3.8 per cent, from the long standing 3 per cent.

In the twice-a-decade Central Financial Work Conference in late October 2023, China announced it would support its financial sector with more regulation and oversight. A new supervisory body will be set up to stabilise the country’s property market. The announcement highlighted the importance of finance to the economy, the country’s focus on creating a favourable monetary and financial environment and its commitment to driving technical innovation.

This policy holds far-reaching implications for China's economy and financial markets. For investors, understanding the implications, potential market reactions and broader economic landscape is crucial, as it opens up opportunities for strategic asset allocation in the Chinese market.

Acknowledging challenges

For many years, the 3 per cent deficit level was considered a ‘red line’ that the government guarded. This shift signals the authorities’ willingness to take a more proactive approach to economic growth and development, sending a positive signal to the market.

While the Rmb1tn addition may not seem colossal, it is expected to provide a 0.4 per cent boost to GDP over the next three to four quarters, according to estimates by the Government Information Office of the State Council.

The fiscal shift also reflects positively on the government's willingness to support the economy. Historically, similar moves in 1998, 2007 and 2020 saw positive market reactions post-announcement. We believe this boost in confidence can have a ripple effect on China's financial markets. In fact, KraneShares CSI China Internet ETF has already witnessed a 4.5 per cent surge overnight following the announcement. This development could potentially offer unique opportunities for investors looking to capitalise on China’s economy and capital market rebound. The significant announcements from the Central Financial Work Conference have further boosted investors’ confidence.

These latest developments also show that top policy-makers in China have demonstrated their awareness of challenges facing the nation’s economy. This acknowledgment is an essential step in addressing the issues head-on.

The government has expressed strong commitment to intervene when necessary, ensuring liquidity for local governments and infrastructure development. This proactive stance indicates their dedication to stabilising the economy. China has once again demonstrated its ability to adapt and respond to economic challenges. This flexibility is an attractive feature for investors seeking stability in their portfolios.

Megatrends and investment opportunities

China's fiscal shift opens doors to various investment opportunities, while the recent policy announcements have also provided a much-needed and long-awaited boost to investor confidence. As these policy changes send a clear message to the market and stimulate economic growth, we believe sectors that directly benefit from consumer spending in China will reflect great investment opportunities.

Today in China, with 870m urban residents out of 1.4bn people (a 62 per cent urbanisation rate), the country aims to modernise further by bringing 20-30 per cent more of its population to cities in the coming decades. This vast and distinct middle-class customer base makes China unparalleled, offering unique opportunities for businesses, especially internet companies, focusing on comprehensive one-stop services. As more Chinese citizens transition into the middle class, their disposable income and consumption patterns are changing, which presents significant and long-term opportunities for investors.

On the macro level, the environment is set to pro-growth with China’s central bank rate cuts creating an easing monetary environment. Post zero-Covid, domestic consumption in China has come back slowly and partly due to decline in wealth of Chinese households, driven by falling property prices. But the Chinese government is making policy adjustments like waiving home buying restrictions and redefining the concept of ‘first-time home buyer’, in order to support property prices. This should help boost domestic consumption in China.

Currently, the equity market in China has been grappling with a decade-low valuation, driven primarily by concerns related to macroeconomic factors. Performance is detached from fundamentals as the “sum of all fear” drove investors away from the space in 2022. Policy-makers have come to recognise that boosting investor confidence is paramount.

In light of this, China has adopted a multifaceted approach. The People's Bank of China has adopted an accommodative monetary policy, while the central government has issued bonds. Moreover, the recent policy announcements signify the government's commitment to ongoing reforms and welcome international investments. These combined efforts suggest China's dedication to bolstering investor trust and belief in the country's economic fundamentals.

Investors are expected to gradually shed their concerns as they realise that the fundamentals of Chinese corporations remain robust. These companies are actively consolidating their positions, and the signs of revenue growth are already evident.

As China strengthens its domestic economy, we believe the stock market is poised for a growth phase, where we fundamentals should drive equity performance. This presents an attractive incentive for global investors to reward robust earnings of China companies, which have yet to be fully reflected in stock performance.

Geopolitics: an improving factor for China

Geopolitical concerns have been at the forefront of investors' minds, but there are promising signs that bode well for those considering investment opportunities in China.

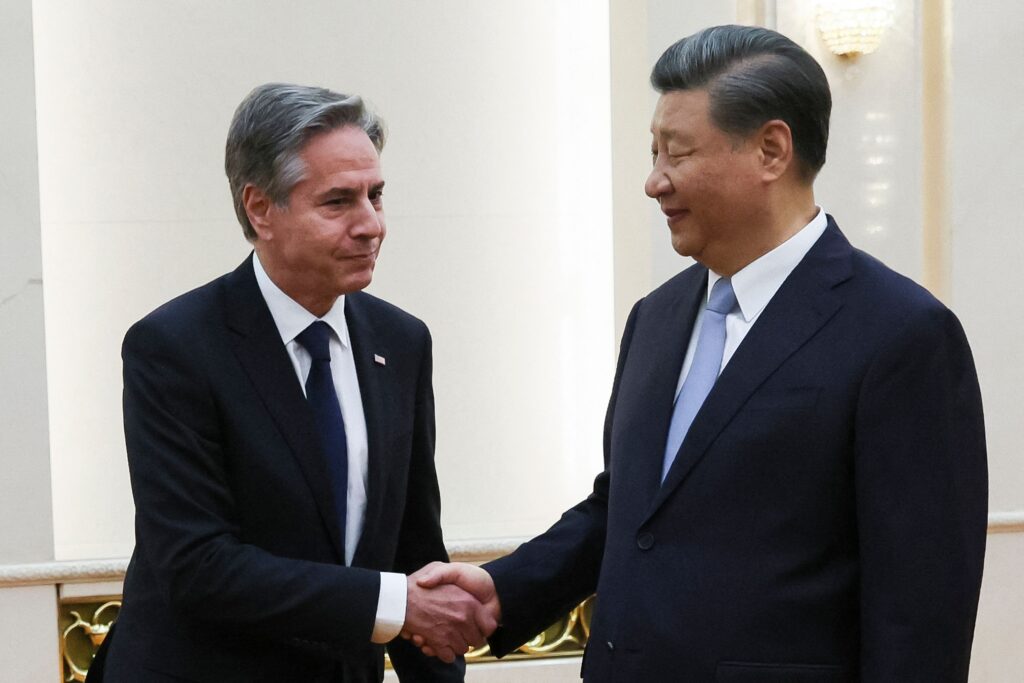

Key figures are engaging in constructive dialogues, exemplifying the potential for increased cooperation between the US and China. China's minister of commerce and the US secretary of commerce’s meeting in Washington in May 2023 highlights the commitment to strengthening economic ties. The visits of prominent business leaders like Elon Musk and Jamie Dimon to China in the same month signal that China is open to international business. High-level summits, such as US secretary of state Antony Blinken meeting with president Xi Jinping in June, US treasury secretary Janet Yellen's visit to China in July, and President Xi’s meeting with a US Senate delegation led by majority leader Charles Schumer in October, all point to a positive trajectory in diplomatic relations. The White House also announced that Mr Biden and Mr Xi will be meeting in November 2023.

These developments showcase the improving geopolitical landscape and it is evident that the two nations continue to serve as crucial trade partners and revenue generators for their respective economies. This aligns with what investors are seeking – a co-operative strategy to tackle challenges. We believe collaborative efforts are in the best interests of both countries, and they should continue to work together for mutual benefits.

Strategic approach

China’s recent policy announcements have resonated positively with investors, instilling a much-needed boost in confidence. With domestically focused policy-making and a substantial consumer base, China provides diversification benefits and improved risk-adjusted returns for long-term investments.

Investors should consider the opportunities presented by the nation’s strategic approach to economic recovery and stability, keeping in mind the potential for gains in domestic consumption trends.

China continues to play a vital role in the global economy, that leads us to believe strategic allocation to Chinese assets can enhance portfolio resilience and long-term returns.

Xiaolin Chen is head of international at KraneShares