A handful of mega-cap tech stocks have driven the US market’s gains in 2023.

The American economy has proved resilient in the face of the US Federal Reserve’s tight monetary policy, as it battles to bring down inflation. Yet the extended rate-hiking cycle is beginning to take its toll. Economic growth appears to be slowing, while US stocks have seen a pullback. But are we in line for a hard landing or will the economy’s resilience continue?

We are now nearing the end of the Fed’s rate-hiking cycle, believes Sandy Sanders, senior portfolio manager at Manulife Investment Management, pointing out that US consumers started the cycle with their “best balance sheets” in 40 years.

“If you break up wage earners by quintile, into five 20 per cent buckets, it’s the only the bottom one we worry about. That’s where wages aren’t keeping up with inflation,” he says, adding that this cohort represents only 8 per cent of retail sales.

The middle three quintiles - the middle class - remains healthy, with full employment and rising incomes, he says, with no sign of a housing bubble. Moreover, after 10 years of stress tests, the banks are “basically squeaky clean”, a very different situation compared with the run-up to the financial crisis in 2008.

“All this points to a soft landing for the US economy. We’re going through that right now,” believes Mr Sanders. “Growth has slowed, whether it is car sales, housing or retail sales, but we’re not crashing down and causing unemployment to rise.”

This makes now a constructive time to take advantage of the recent pullback in equities, he believes, having added to positions in software companies, and also favouring consumer discretionary, financials and communication services.

In the latter group he highlights legacy media companies which have struggled with the shift to online streaming, but have deep media libraries. “The large tech companies, be it Amazon or Apple, need content, and we think there might be some transformative deals coming over the next year or two.”

In contrast, Manulife underweights more expensive sectors, such as dividend-payers, healthcare, utilities, consumer staples, industrials, and metals and mining.

Beginning to bite

The impact of higher interest rates is beginning to take its economic toll, says Julien Albertini, portfolio manager and senior research analyst in the global value team at First Eagle Investments. Delinquency rates for credit cards and subprime auto loans are rising on the consumer side, while default rates for leveraged loans are increasing in the corporate sector, particularly affecting lower-rated issuers.

“Sectors sensitive to financing rates, such as housing, are feeling the impact, with existing home sales declining,” he says, adding that the current environment makes out-of-favour real estate worth exploring.

Much of the US market’s recent gains have been driven by mega-cap technology companies, but to expect similar returns over coming years would be unwise, warns Anthony Kingsley, CIO at Findlay Park Partners, an investment firm.

For one, using history as a guide, the world’s largest companies rarely stay the same from one decade to the next, while the coming years will be very different to those we have just lived through, for example with higher interest rates. The biggest names could also face rising regulatory pressure. “Disruption is endemic in the US — we have a vibrant capitalist economy,” he says.

Much better opportunities are available in the $3bn to $50bn US mid-cap space, with no need to compromise on quality, insists Mr Kingsley, and valuations in this sector are extremely attractive.

Looking at the ESG trend, he points to a backlash in the US, but from an investment standpoint, climate economics presents a clear opportunity. “There may be no consensus as to when, or even if, fossil fuels have to be phased out, but there is a consensus that innovation has to happen,” he says. “We need low-carbon energy, technology and resilience. That is exactly what is happening in the US, with the bipartisan jobs acts, helping businesses develop low-carbon innovation.”

Tech titans

The mega-cap tech stocks are sometimes referred to as ‘The Magnificent Seven’, comprising Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta Platforms (see box, page 65). While, up until the week ending October 13 2023, the S&P 500 was up nearly 13 per cent year-to-date, the equal-weighted S&P 500 was down almost 1 per cent. Put simply, the Magnificent Seven have been almost entirely responsible for performance of the S&P 500 so far in 2023.

But the enthusiasm around AI, which has driven much of this gain, is based on a picture that is far from clear, says Michael Clarfeld, portfolio manager at ClearBridge, a global equity manager.

“While we acknowledge the potential of AI, we are circumspect about the narrow and one-sided nature of AI mania. It is far too early to declare winners and seems entirely possible to us that AI could be a net negative for society,” he explains.

AI seems sure to displace many workers and such a profound shift could prove both socially and politically unsettling. Economically, large AI-driven layoffs could gut aggregate demand and increase economic inequality, says Mr Clarfeld.

“Such a dystopian outcome could result in lower aggregate earnings, simultaneously causing investors to employ higher discount rates and raise their required return thresholds, a double whammy for asset prices. Such a negative outcome is not our base case, but is possible.”

The technology could turn out to be beneficial for humanity, he explains, but that does not mean its path will be smooth. Significant previous shifts, like the Industrial Revolution, have been profoundly disruptive and choppy.

“AI will create huge new winners, but their progress will inevitably be bumpy. With the market now imputing trillions of dollars of value into a small handful of perceived AI winners, it seems likely these stocks will face turbulence in the years ahead,” he adds.

Others are more optimistic on outlook for mega-cap stocks. The Magnificent Seven will continue to do well, says Saira Malik, CIO at Nuveen, though specific names and margins of outperformance may be subject to change.

“Global digitalisation is a secular trend favouring mega-cap tech companies,” she says. “Those meaningfully engaged in paradigm-shifting technologies such as artificial intelligence, that have defensible margins, appear best-positioned for long-term success.”

Citi seeks to identify “fairly valued” growth companies, and likes the small and mid-cap space in the US. “We have identified a huge valuation gap between those and larger growth equities and are recommending an overweight,” says David Bailin, chief investment officer at Citi Global Wealth.

He points out that rising yields in fixed income make this a very good time to construct a balanced portfolio. “Investors have the chance to earn real yields in the bond market, or to put money into equites. You have real opportunities for returns on both sides of the ledger, which brings diversification benefits, so it is a great time to be starting a 60/40 portfolio.”

China globalisation proxy

Not all are so optimistic about US stockmarket prospects. “We believe the upside potential for US equities over the next couple of years is considerably smaller than for other equity markets,” says Rupert Thompson, chief economist at Kingswood, pointing to excessively high valuations.

“US equities have for good reason always been relatively expensive, but their premium to the rest of the world is currently 50 per cent, more than double the long-term average,” explains Mr Thompson, expecting outperformance of tech mega-cap stocks to wane in the face of higher interest rates and increased regulation.

US outperformance in recent years has also been fuelled by dollar strengthening, with the Greenback now looking considerably overvalued, adds Mr Thompson. “If the dollar weakens, as we expect, this will reinforce the underperformance in common currency terms.”

The fact that a US Treasury bill is paying 5.5 per cent for no risk has changed things for investors. GAM Investments allocates across equities, fixed income and alternatives in a fund of fund structure, and Julian Howard, its lead investment director, multi-asset solutions, says allocations to equities are neutral, which is effectively as low as they will go.

“Treasuries are giving you upside without the risk and hassle of owning equities. And as long as that situation persists, it’s very hard to get excited about the equity class,” he says.

The US stockmarket is overvalued, says Mr Howard, but he would still not bet against it.

“The US remains, in our mind, the most attractive equity market there is. It’s highly defensive, it’s highly liquid, it’s got the best return on equity,” he says. “America’s got the best quality corporate management. And if things go wrong, Asia and Europe will come tumbling down much faster.”

Within US equities, GAM recommends embedding a little more safety, rotating out of an ESG-labelled ETF, where flows have started to slow, into a quality equity product.

China makes for a very appealing investment, says Mr Howard, despite all the “China-bashing” of recent years.

“China as a proxy for globalisation has become this kind of bogeyman, both from left and right, in the US,” he says. Democrats were suspicious of free trade, while Republicans have pushed the dispossessed white working class, Rust Belt narrative.

“Donald Trump tapped into that so successfully. So, I think China is useful on both sides of the equation.”

There are those within the current US administration who recognise the importance of Sino-US relations, that the two are not “adversaries, but competitors”, but Mr Howard expects the relationship to be a key to political debate as we approach the US presidential election.

For years, China has been the US’s largest trading partner, with rapidly expanding consumer markets providing fertile growth opportunities for both countries’ respective multinationals, says Nuveen’s Ms Malik. Recent geopolitical tensions and economic trends point to an increasingly complicated relationship between the two countries.

“While these trends may point to dwindling prospects for mutual economic prosperity for the two countries, they also present tremendous opportunities for US-based companies to ‘reshore’ some manufacturing operations, or ‘nearshore’ them to trading partners closer to home, like Mexico,” she says.

Indeed, in July, Mexico supplanted China as the largest source of imported goods for the US, according to the US Census Bureau. “As the US continues to streamline supply chains, we expect this type of activity to accelerate and play a bigger role in the US economy,” adds Ms Malik.

For the asset and wealth management industry, it appears that medium-term trends for investment will increasingly be shaped by geopolitics.

VIEW FROM MORNINGSTAR: Magnificent seven ride to rescue

The US equity market rose substantially in 2023 amid a rate hiking cycle which has proved one of the steepest and fastest of the past 40 years.

The target federal funds rate has surged from nearly zero in early 2022 to 5.5 per cent so far in 2023. Growth stocks drove returns in the first half of the year. While the market gave up some of these gains in the most recent quarter, value stocks beat growth against a backdrop of continued macroeconomic and geopolitical concerns, a sharp rise in US Treasuries, a renewed surge in the oil price and sticky inflation.

Despite this setback, the Morningstar US Market Total Return Index is up 12.8 per cent in dollar terms through to the end of September.

The stockmarket rally has been unusually concentrated this year. Large cap stocks once again outperformed smaller companies.

According to an attribution analysis of the Morningstar US Market Index, the returns from only seven mega-cap stocks accounted for more than two-thirds of total market return at the end of the past quarter, even though the stocks that represent the ‘Magnificent Seven’ ran out of steam during Q3.

Technology stocks now account for 28 per cent of the broad market index, close to the late 1990s tech bubble peak, as investor excitement surrounding emergence of artificial intelligence drove stocks significantly higher for any companies that may benefit from future implementation of this technology.

Narrow market leadership created a challenging environment for active funds. The average fund in the Morningstar US Large-Cap Blend equity category gained 11.3 per cent in dollar terms for the year as of end September, underperforming the market by 1.5 percentage points. The seven mega-caps were widely held across portfolios, but not always to the same extent as their index weights.

Active managers have been most positive on Microsoft, with an average weight of 7.8 per cent compared to the index’ 5.9 per cent. They tended to have overweightings in Apple and Alphabet, but at 0.7 per cent, their average position in top performer, Nvidia, was just a third of the index weight. Many funds also took a cautious stance towards Meta Platforms, second-best performer among the Magnificent Seven.

Cheap market-cap weighted passive strategies were beneficiaries of this top-heavy market environment. That said, 33.8 per cent of active equity funds in the Morningstar US Large-Cap Blend category outperformed passive competitors in the first half of 2023, despite the challenging backdrop. This compares favourably to the past 10 years, when their success rates were only in single digits.

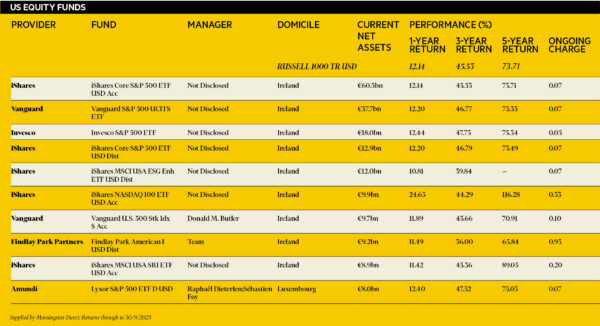

Investors continued to pull money out of growth-oriented US large-cap equity funds in 2023, as rising interest rates weighed on sentiment for long-duration, high-growth stocks. Europe-domiciled funds recorded outflows of €5.3bn ($5.6bn) through September. US large-cap value funds fared even worse, with €6.2 bn of net outflows in the year-to-date, while blended funds garnered inflows of €10.8bn. As in previous years, investors favoured passive strategies for US large-cap equity exposure.

Natalia Wolfsetter, Director of Manager Research, Morningstar Benelux.